Question: Solve Problem 1 again, but this time assume that during the next two years, Microsoft will on average perform 6 percent better per year than

Solve Problem 1 again, but this time assume that during the next two years, Microsoft will on average perform 6 percent better per year than it performed during the 1997–2002 period for which you have data.

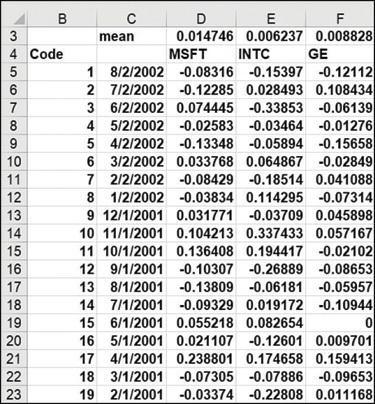

B 3 4 Code 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 D E F 0.014746 0.006237 0.008828 MSFT INTC GE 1 8/2/2002 -0.08316 -0.15397 -0.12112 2 7/2/2002 -0.12285 0.028493 0.108434 3 6/2/2002 0.074445 -0.33853 -0.06139 4 5/2/2002 -0.02583 -0.03464 -0.01276 mean 5 4/2/2002 -0.13348 6 3/2/2002 0.033768 7 2/2/2002 -0.08429 -0.05894 -0.15658 0.064867 -0.02849 -0.18514 0.041088 8 1/2/2002 -0.03834 0.114295 -0.07314 10 11/1/2001 9 12/1/2001 0.031771 -0.03709 0.045898 0.104213 0.337433 0.057167 11 10/1/2001 0.136408 0.194417 -0.02102 -0.10307 -0.26889 -0.08653 -0.13809 -0.06181 -0.05957 12 9/1/2001 13 8/1/2001 14 7/1/2001 -0.09329 0.019172 -0.10944 6/1/2001 0.055218 0.082654 15 0 16 5/1/2001 0.021107 -0.12601 0.009701 17 4/1/2001 0.238801 0.174658 0.159413 18 3/1/2001 -0.07305 -0.07886 -0.09653 19 2/1/2001 -0.03374 -0.22808 0.011168

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

To solve this problem we need to first calculate the expected return for Microsoft over ... View full answer

Get step-by-step solutions from verified subject matter experts