Becker Ltd. is a private Canadian company. It has been preparing its financial statements in accordance with

Question:

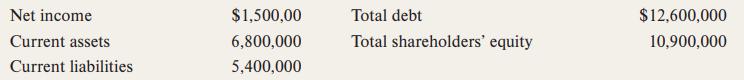

Becker Ltd. is a private Canadian company. It has been preparing its financial statements in accordance with ASPE but is now considering a change to IFRS. For its Year 4 financial statements, Becker reported the following in accordance with ASPE:

You have identified the following three areas in which Becker’s accounting policies have differences between ASPE and IFRS:

1. Impaired loans

2. Capitalization of interest

3. Actuarial gains/losses

The controller at Becker provides the following information with respect to each of these accounting differences and indicates that the Year 4 financial statements reflect the proper accounting for these items in accordance with ASPE:

Impaired Loans

One of Becker’s debtors is in financial difficulty and defaulted on its loan payment during the year. The outstanding balance on this loan receivable at the end of Year 4 was $480,000. Becker agreed to delay the annual payments for two years. The discounted present value of the delayed future payments as of December 31, Year 4, was $440,000 when discounted at the original interest rate on the loan of 6% or $452,000 when discounted at the market rate of interest for this type of loan of 5%.

Interest Costs

Becker borrowed $500,000 on June 30, Year 3, to finance the construction of a storage facility. Interest-only payments at the annual rate of 6% are payable every six months until the completion of the facility. Thereafter, principal and interest payments are payable every six months over a 10-year period to fully pay off the loan. The facility was completed in January, Year 5. Becker has been expensing the interest costs as incurred.

Actuarial Gains/Losses

Becker instituted a defined benefit pension plan in Year 3. The first actuarial evaluation, which was done as at September 30, Year 4, indicated an actuarial loss of $115,000 and an overall pension fund deficit of $750,000. The CEO is concerned about the impact of converting Becker’s financial statements from ASPE to IFRS on the following metrics: current ratio, debt-to-equity ratio, and return on total shareholders’ equity.

Required

(a) Calculate the three ratios first using ASPE and then using IFRS. Prepare a schedule showing any adjustments to the numerator and denominator for these ratios. Ignore income taxes.

(b) Explain whether Becker’s liquidity, solvency, and profitability look better or worse under IFRS after considering the combined impact of the three areas of difference.

Step by Step Answer:

Modern Advanced Accounting In Canada

ISBN: 9781260881295

10th Edition

Authors: Hilton Murray, Herauf Darrell