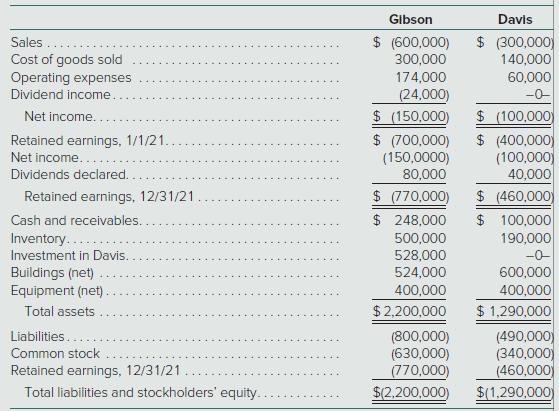

Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2021:

Question:

Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2021:

Gibson acquired 60 percent of Davis on April 1, 2021, for $528,000. On that date, equipment owned by Davis (with a five-year remaining life) was overvalued by $30,000. Also on that date, the fair value of the 40 percent noncontrolling interest was $352,000. Davis earned income evenly during the year but declared the $40,000 dividend on November 1, 2021.

a. Prepare a consolidated income statement for the year ending December 31, 2021.

b. Determine the consolidated balance for each of the following accounts as of December 31, 2021:

Goodwill Buildings (net)

Equipment (net) Dividends Declared

Common Stock

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik