Question: For this problem, refer to the information provided in Problem 13-3 for P Company and SFr Company. Ignore deferred income taxes in the assignment of

For this problem, refer to the information provided in Problem 13-3 for P Company and SFr Company. Ignore deferred income taxes in the assignment of the difference between implied and book value.

Required:

A. If you have not already done so, prepare a workpaper to translate the trial balance of the subsidiary into dollars using the current rate method.

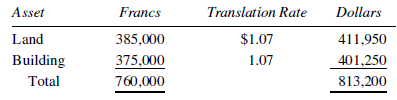

B. Prepare the journal entries made on the books of P Company during 2020 to account for its investment in SFr Company. P Company uses the cost method to record its investment in SFr Company. At the date of acquisition, the 760,000 franc difference between implied and book value interest acquired was allocated as follows:

The building is depreciated over a 10-year remaining life using the straight-line method of amortization.

C. Prepare a consolidated statement?s workpaper at December 31, 2020.

Data from 13-3

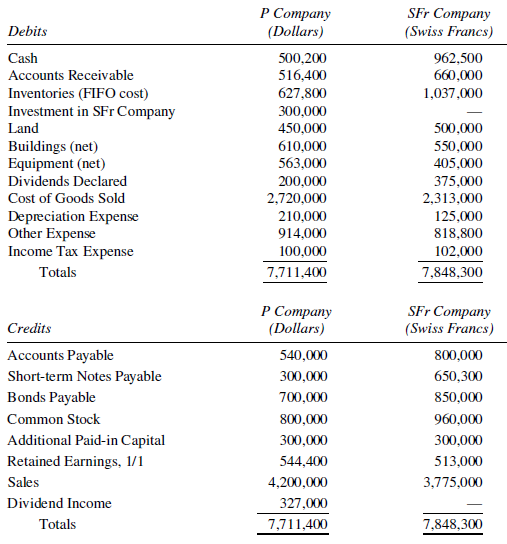

On January 2, 2019, P Company, a U.S.-based company, acquired for 2,000,000 francs an 80% interest in SFr Company, a Swiss company. On January 2, 2019, SFr Company reported a retained earnings balance of 480,000 francs. SFr?s books are maintained in Swiss francs and are in conformity with U.S. generally accepted accounting principles. Trial balances of the two companies as of December 31, 2020, are presented here:

Other information related to the subsidiary follows:1. Beginning inventory of 830,000 Swiss francs was acquired when the exchange rate was $1.078.2. Purchases made uniformly throughout 2020 were 2,520,000 francs.3. The Swiss franc is identified as the subsidiary?s functional currency.4. The subsidiary?s beginning (1/1/20) retained earnings and cumulative translation adjustment (credit) in dollars were $175,948 and $390,691 respectively.5. All plant assets were acquired before the parent obtained a controlling interest in the subsidiary.6. Sales are made and all expenses are incurred uniformly throughout the year.7. The ending inventory was acquired during the last quarter.8. The subsidiary declared and paid dividends of 375,000 francs on September 2.9. The following direct exchange rate quotations were available:Date of subsidiary acquisition ............................ ?$1.07Average for 2014 .................................................. ? ?1.075January 1, 2015 ..................................................... ? ?1.08September 2, 2015 ............................................... ? ?1.09December 31, 2015 .............................................. ? ?1.10Average for the 4th quarter, 2015 ..................... ? ?1.095Average for 2015 ................................................. ? ? 1.085

Translation Rate Asset Francs Dollars 385,000 Land Building 411,950 $1.07 1.07 401,250 401.250 375,000 Total 760,000 813,200 Cany SFr Company (Swiss Francs) Debits (Dollars) Cash 500,200 962,500 660,000 Accounts Receivable 516,400 Inventories (FIFO cost) Investment in SFr Company 627,800 1,037,000 300,000 450,000 610,000 Land 500,000 Buildings (net) Equipment (net) 550,000 563,000 405,000 Dividends Declared 200,000 375,000 Cost of Goods Sold 2,720,000 2,313,000 Depreciation Expense Other Expense Income Tax Expense 210,000 125,000 914,000 100,000 818,800 102,000 Totals 7,711,400 7,848,300 P Company (Dollars) SFr Company (Swiss Francs) Credits Accounts Payable 540,000 800,000 Short-term Notes Payable 300,000 650,300 Bonds Payable 700,000 850,000 Common Stock 800,000 960,000 Additional Paid-in Capital 300,000 300,000 Retained Earnings, 1/1 544,400 513,000 Sales 4,200,000 3,775,000 Dividend Income 327,000 Totals 7,711,400 7,848,300

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

P COMPANY AND SUBSIDIARY Consolidated Workpaper For the Year Ended December 31 2020 P SFr Eliminatio... View full answer

Get step-by-step solutions from verified subject matter experts