G Company is considering the takeover of K Company whereby it will issue 7,400 common shares for

Question:

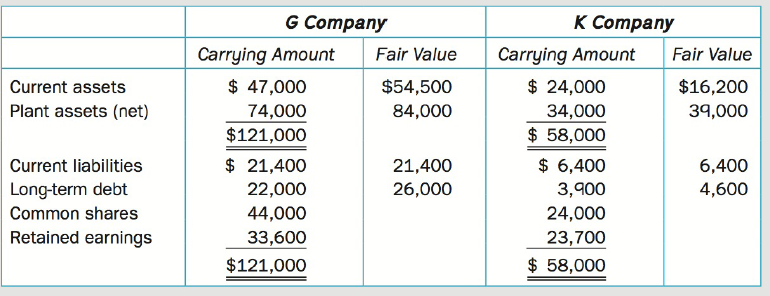

G Company is considering the takeover of K Company whereby it will issue 7,400 common shares for all of the outstanding shares of K Company. K Company will become a wholly owned subsidiary of G Company. Prior to the acquisition, G Company had 13,000 shares outstanding, which were trading at $8.00 per share. The following information has been assembled:

(a) Prepare G Company's consolidated balance sheet immediately after the combination using the direct method and using

(i) The acquisition method, and

(ii) The new-entity method.

(b) Calculate the current ratio and debt-to-equity ratio for G Company under both methods. Explain which method shows the strongest liquidity and solvency position and which method

best reflects the true financial condition of the company.

(c) Prepare G Company's consolidated balance sheet immediately after the combination using the worksheet approach and using the acquisition method.

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell