Question: In 2021, assuming K-Tech has declared no dividends, what are the noncontrolling interests share of the subsidiarys income and the ending balance of the noncontrolling

In 2021, assuming K-Tech has declared no dividends, what are the noncontrolling interest’s share of the subsidiary’s income and the ending balance of the noncontrolling interest in the subsidiary?

a. $26,000 and $230,000

b. $28,800 and $252,000

c. $34,400 and $240,800

d. $40,000 and $252,000

On January 1, 2020, French Company acquired 60 percent of K-Tech Company for $300,000 when K-Tech’s book value was $400,000. The fair value of the newly comprised 40 percent noncontrolling interest was assessed at $200,000. At the acquisition date, K-Tech’s trademark (10-year remaining life) was undervalued in its financial records by $60,000. Also, patented technology (5-year remaining life) was undervalued by $40,000.

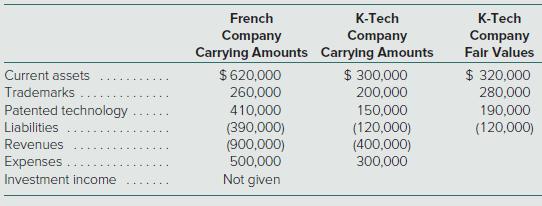

In 2020, K-Tech reports $30,000 net income and declares no dividends. At the end of 2021, the two companies report the following figures (stockholders’ equity accounts have been omitted):

French -ech -ech Company Carrying Amounts Carrying Amounts Company Company Fair Values $ 320,000 280,000 $ 300,000 200,000 Current assets $620,000 Trademarks 260,000 Patented technology Liabilities 410,000 150,000 (120,000) (400,000) 300,000 190,000 (390,000) (900,000) 500,000 Not given (120,000) Revenues Expenses Investment income

Step by Step Solution

3.31 Rating (154 Votes )

There are 3 Steps involved in it

C 2021 KTech net income 100000 14000 excess amortizations 86000 Noncontrolling interest percentage ... View full answer

Get step-by-step solutions from verified subject matter experts