On January 1, 2017, Perry Company purchased 80% of Selby Company for $990,000. At that time Selby

Question:

On January 1, 2017, Perry Company purchased 80% of Selby Company for $990,000. At that time Selby had capital stock outstanding of $350,000 and retained earnings of $375,000. The fair value of Selby Company?s assets and liabilities is equal to their book value except for the following:

One-half of the inventory was sold in 2017, the remainder was sold in 2018. At the end of 2017, Perry Company had in its ending inventory $60,000 of merchandise it had purchased from Selby Company during the year. Selby Company sold the merchandise at 25% above cost. During 2018, Perry Company sold merchandise to Selby Company for $310,000 at a markup of 20% of the selling price. At December 31, 2018, Selby still had merchandise that it purchased from Perry Company for $82,000 in its inventory.

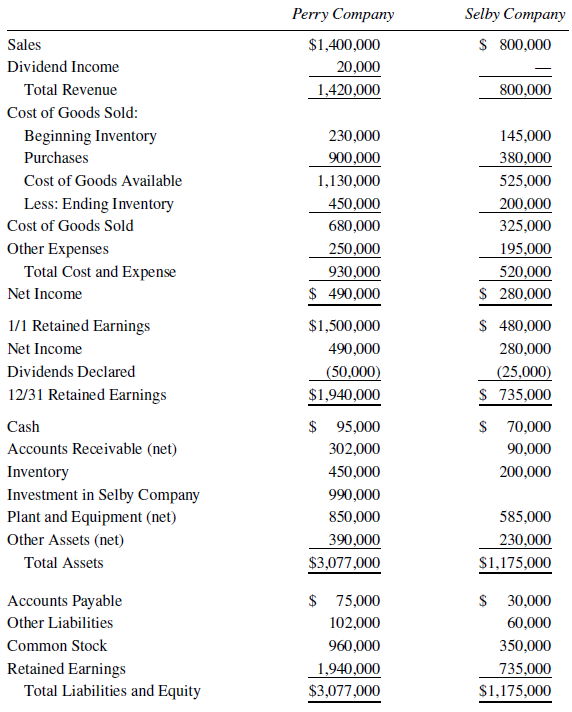

Financial data for 2018 are presented here:

Required:

A. Prepare the consolidated statements workpaper for the year ended December 31, 2018.

B. Calculate consolidated retained earnings on December 31, 2018, using the analytical or taccount approach.

Step by Step Answer: