On January 1, 2022, Plymouth Corporation acquired 80 percent of the outstanding voting stock of Sander Company

Question:

On January 1, 2022, Plymouth Corporation acquired 80 percent of the outstanding voting stock of Sander Company in exchange for $1,200,000 cash. At that time, although Sander’s book value was $925,000, Plymouth assessed Sander’s total business fair value at $1,500,000. Since that time, Sander has neither issued nor reacquired any shares of its own stock.

The book values of Sander’s individual assets and liabilities approximated their acquisition-date fair values except for the patent account, which was undervalued by $350,000. The undervalued patents had a five-year remaining life at the acquisition date. Any remaining excess fair value was attributed to goodwill. No goodwill impairments have occurred.

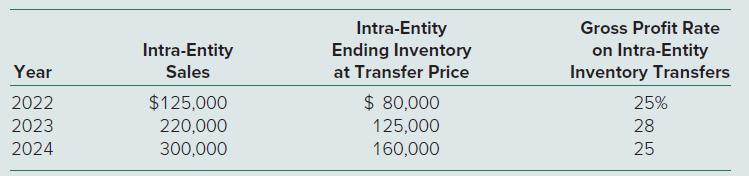

Sander regularly sells inventory to Plymouth. The following are details of the intra-entity inventory sales for the past three years:

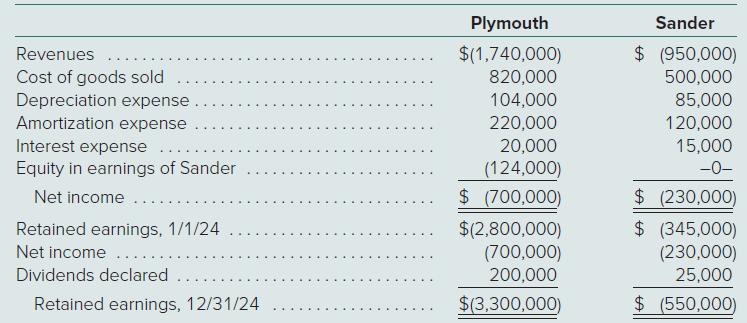

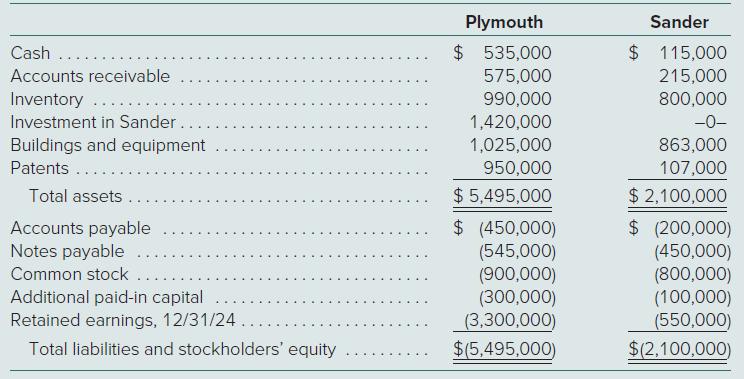

Separate financial statements for these two companies as of December 31, 2024, follow:

a. Prepare a schedule that calculates the Equity in Earnings of Sander account balance.

b. Prepare a worksheet to arrive at consolidated figures for external reporting purposes. At yearend, there are no intra-entity payables or receivables.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik