On January 1, 2023, Perlman Corporation exchanged $1,710,000 cash for 90 percent of the outstanding voting stock

Question:

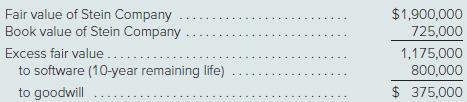

On January 1, 2023, Perlman Corporation exchanged $1,710,000 cash for 90 percent of the outstanding voting stock of Stein Company. The consideration transferred by Perlman provided a reasonable basis for assessing the total January 1, 2023, fair value of Stein Company. At the acquisition date, Stein reported the following owners’ equity amounts in its balance sheet:

In determining its acquisition offer, Perlman noted that the values for Stein’s recorded assets and liabilities approximated their fair values. Perlman also observed that Stein had developed software internally with an assessed fair value of $800,000 that was not reflected on Stein’s books. Perlman expected both cost and revenue synergies from the combination.

At the acquisition date, Perlman prepared the following fair-value allocation schedule:

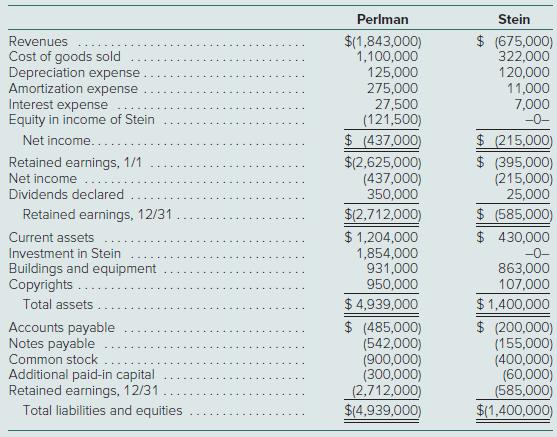

At December 31, 2024, the two companies report the following balances:

At year-end, there were no intra-entity receivables or payables.a. Determine the consolidated balances for this business combination as of December 31, 2024.b. If instead the noncontrolling interest’s acquisition-date fair value is assessed at $167,500, what changes would be evident in the consolidated statements?

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik