On June 1, Parker-Mae Corporation (a U.S.-based company) received an order to sell goods to a foreign

Question:

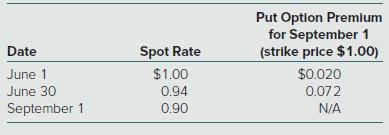

On June 1, Parker-Mae Corporation (a U.S.-based company) received an order to sell goods to a foreign customer at a price of 100,000 francs. Parker-Mae will ship the goods and receive payment in three months, on September 1. On June 1, Parker-Mae purchased an option to sell 100,000 francs in three months at a strike price of $1.00. The company designated the option as a fair value hedge of a foreign currency firm commitment. The option’s time value is excluded in assessing hedge effectiveness, and the change in time value is recognized in net income. The fair value of the firm commitment is measured by referring to changes in the spot rate (discounting to present value is ignored). Relevant exchange rates and option premiums for the franc are as follows:

Parker-Mae Corporation must close its books and prepare its second-quarter financial statements on June 30.

a. Prepare journal entries for the foreign currency option, foreign currency firm commitment, and export sale.

b. What is the impact on net income in each of the two accounting periods?

c. What is the amount of net cash inflow resulting from the sale of goods to the foreign customer?

Step by Step Answer:

Advanced Accounting

ISBN: 9781260247824

14th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik