On May 1, Year 1, JDH orders equipment from a supplier in Germany for 100,000 with delivery

Question:

On May 1, Year 1, JDH orders equipment from a supplier in Germany for €100,000 with delivery scheduled for October 1, Year 1. Payment is due on December 31, Year 1. On May 2, Year 1 JDH enters into an 8-month forward contract with its bank at a rate of €1 = $1.38 to purchase €100,000 on December 31, Year 1, the date the accounts payable is due. The equipment is delivered on October 1, Year 1, and immediately put into use. The forward contract and the payable to the supplier are settled on December 31, Year 1.

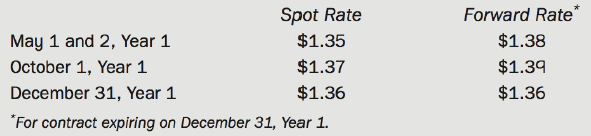

Exchange rates for one euro for Year 1 were as follows:

Required:

Prepare journal entries to reflect the above transactions from May 1 to December 31, Year 1, excluding adjusting entry for depreciation expense. Assume that JDH designates the forward contract as a cash-flow hedge and clears the cumulative other comprehensive income account when the equipment is delivered on October 1, Year 1.

Accounts PayableAccounts payable (AP) are bills to be paid as part of the normal course of business.This is a standard accounting term, one of the most common liabilities, which normally appears in the balance sheet listing of liabilities. Businesses receive...

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell