Pitino acquired 90 percent of Breys outstanding shares on January 1, 2022, in exchange for $342,000 in

Question:

Pitino acquired 90 percent of Brey’s outstanding shares on January 1, 2022, in exchange for $342,000 in cash. The subsidiary’s stockholders’ equity accounts totaled $326,000, and the noncontrolling interest had a fair value of $38,000 on that day. However, a building (with a 9-year remaining life) in Brey’s accounting records was undervalued by $18,000. Pitino assigned the rest of the excess fair value over book value to Brey’s patented technology (6-year remaining life).

Brey reported net income from its own operations of $64,000 in 2022 and $80,000 in 2023. Brey declared dividends of $19,000 in 2022 and $23,000 in 2023.

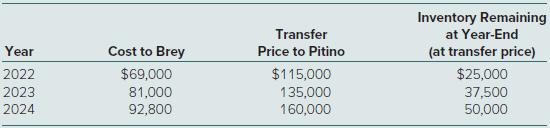

Brey sells inventory to Pitino as follows:

At December 31, 2024, Pitino owes Brey $16,000 for inventory acquired during the period.

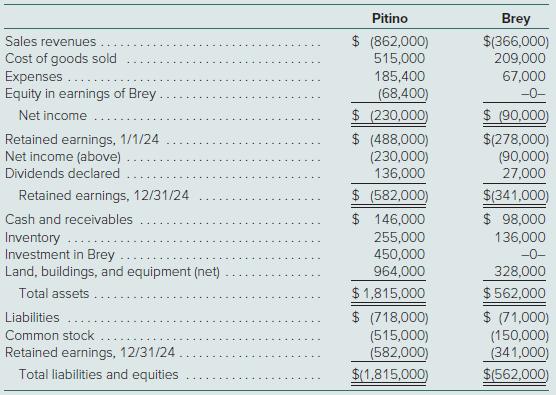

The separate account balances for the two companies at December 31, 2024, and the year then ended follow. Credits are indicated by parentheses.

Answer each of the following questions:a. What was the annual amortization resulting from the acquisition-date fair-value allocations?b. Were the intra-entity transfers upstream or downstream?c. What intra-entity gross profit in inventory existed as of January 1, 2024?d. What intra-entity gross profit in inventory existed as of December 31, 2024?e. What amounts make up the $68,400 Equity in Earnings of Brey account balance for 2024?f. What is the net income attributable to the noncontrolling interest for 2024?g. What amounts make up the $450,000 Investment in Brey account balance as of December 31, 2024?h. Prepare the 2024 worksheet entry to eliminate the subsidiary’s beginning owners’ equity balances.i. Without preparing a worksheet or consolidation entries, determine the consolidation balances for these two companies.

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik