Select the best answer choice for each of the following items: 1. Which of the following receipts

Question:

Select the best answer choice for each of the following items:

1. Which of the following receipts is properly recorded as unrestricted current funds on the books of a university?

(a) Tuition.

(b) Student laboratory fees.

(c) Housing fees.

(d) Research grants.

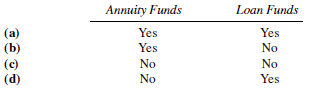

2. The current funds group of a NFP private university includes which of the following?

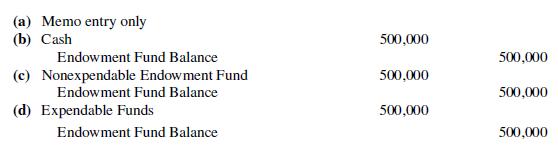

3. On January 2, 2020, John Reynolds established a $500,000 trust, the income from which is to be paid to Mansfield University for general operating purposes. The Wyndham National Bank was appointed by Reynolds as trustee of the fund. What journal entry is required on Mansfield?s books?

4. For the fall semester of 2020, Cherry College assessed its students $2,300,000 for tuition and fees. The net amount realized was only $2,100,000 because of the following revenue reductions:

Refunds occasioned by class cancellations and student withdrawals ......... ? ?$ 50,000

Tuition remissions granted to faculty members? families ............................. ? ? ? ?10,000

Scholarships and fellowships ........................................................................... ? ? ? 140,000

How much should Cherry College report for the period for unrestricted current funds revenues from tuition and fees?

(a) $2,100,000.

(b) $2,150,000.

(c) $2,250,000.

(d) $2,300,000.

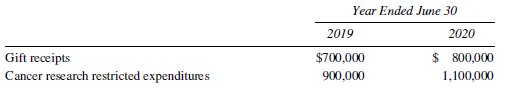

5. During the years ending June 30, 2019, and June 30, 2020, Schafer University conducted a cancer research project financed by a $2,000,000 gift from an alumnus. This entire amount was pledged by the donor on July 10, 2013, although he paid only $500,000 at that date. The gift was restricted to the financing of this particular research project. During the two-year research period, Schafer?s related gift receipts and research expenditures were as follows:

How much gift revenue should Schafer University report in the temporarily restricted column of its statement of activities for the year ended June 30, 2020?

(a) $0.

(b) $800,000.

(c) $1,100,000.

(d) $2,000,000.

Step by Step Answer: