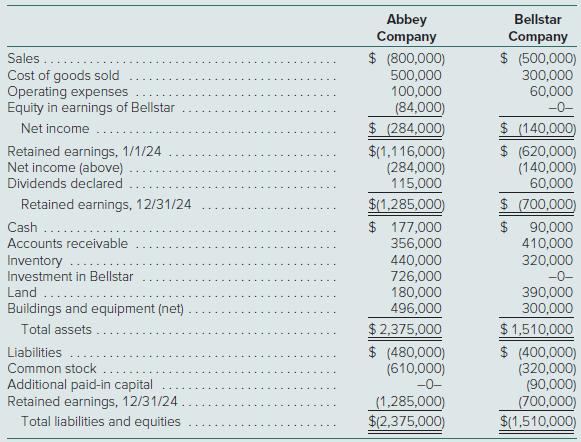

The individual financial statements for Abbey Company and Bellstar Company for the year ending December 31, 2024,

Question:

The individual financial statements for Abbey Company and Bellstar Company for the year ending December 31, 2024, follow. Abbey acquired a 60 percent interest in Bellstar on January 1, 2023, in exchange for various considerations totaling $570,000. At the acquisition date, the fair value of the noncontrolling interest was $380,000 and Bellstar’s book value was $850,000. Bellstar had developed internally a trademark that was not recorded on its books but had an acquisition-date fair value of $100,000. This intangible asset is being amortized over 20 years. Abbey uses the partial equity method to account for its investment in Bellstar.

Abbey sold Bellstar land with a book value of $60,000 on January 2, 2023, for $100,000. Bellstar still holds this land at the end of the current year.

Bellstar regularly transfers inventory to Abbey. In 2023, it shipped inventory costing $100,000 to Abbey at a price of $150,000. During 2024, intra-entity shipments totaled $200,000, although the original cost to Bellstar was only $140,000. In each of these years, 20 percent of the merchandise was not resold to outside parties until the period following the transfer. Abbey owes Bellstar $40,000 at the end of 2024.

a. Prepare a worksheet to consolidate the separate 2024 financial statements for Abbey and Bellstar.b. How would the consolidation entries in requirement (a) have differed if Abbey had sold a building on January 2, 2023, with a $60,000 book value (cost of $140,000) to Bellstar for $100,000 instead of land, as the problem reports? Assume that the building had a 10-year remaining life at the date of transfer.

Step by Step Answer:

Fundamentals Of Advanced Accounting

ISBN: 9781266268533

9th International Edition

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik