The partnership of Garcia, Iglesias, and Kassabian was formed several years ago as a local tax preparation

Question:

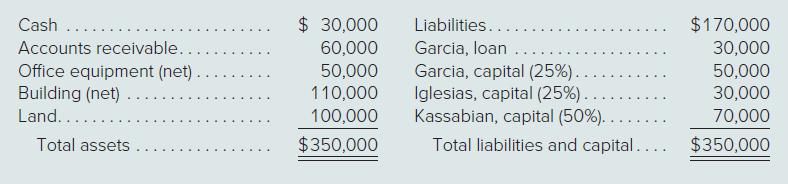

The partnership of Garcia, Iglesias, and Kassabian was formed several years ago as a local tax preparation firm. Two partners have reached retirement age, and the partners have decided to terminate operations and liquidate the business. Liquidation expenses of $34,000 are expected. The partnership balance sheet at the start of liquidation is as follows:

Part A

Prepare a predistribution plan for this partnership.

Part B

The following transactions transpire in chronological order during the liquidation of the partnership:

1. Collected 90 percent of the accounts receivable and wrote the remainder off as uncollectible.

2. Sold the office equipment for $20,000, the building for $80,000, and the land for $120,000.

3. Distributed safe payments of cash.

4. Paid all liabilities in full.

5. Paid actual liquidation expenses of $30,000 only.

6. Made final cash distributions to the partners.

Prepare journal entries to record these liquidation transactions.

Step by Step Answer:

Advanced Accounting

ISBN: 9781264798483

15th Edition

Authors: Joe Ben Hoyle, Thomas Schaefer And Timothy Doupnik