Wedding Planners Limited (WP), owned by Anne and Francois Tremblay, provides wedding planning and related services. WP

Question:

Wedding Planners Limited (WP), owned by Anne and Francois Tremblay, provides wedding planning and related services. WP owns a building (the Pavilion) that has been custom-made for hosting weddings. Usually, WP plans a wedding from start to finish and hosts the wedding day events photos, ceremony, reception, and dance-in the Pavilion. Anne also owns a janitorial company that is involved in the wedding day events. In addition, Francois is the majority owner of a disc jockey company that provides music to weddings and receptions. Selected financial information and details on the ownership of the companies are provided in Exhibit II.

You, CPA, work at Olivier & Myriam Chartered Professional Accountants (OM). The Tremblays have come to you because of events that occurred early in Year 6. While at a wedding at the Pavilion, a negligent act by a guest resulted in a lawsuit by other guests. There was no damage to the Pavilion or any WP property. However, since the incident occurred at a WP event, WP was named as one of several defendants in the lawsuit. Anne and Francois, busy organizing more weddings, were not too concerned. The lawsuit went to court and the judge ruled in favour of the plaintiffs. WP was told to pay $800,000. Somewhat in shock, WP immediately made the payment on September 30, Year 6, and expensed it on the financial statements.

The large cash outflow and financial statement loss eroded WP's financial position to the point that its bank loan was called. WP now has until January 31, Year 7, to repay its $700,000 loan in full to the bank. So far, no other bank approached by WP is willing to loan it money because WP has no collateral to offer beyond the building. However, WP has found a financing company that is willing to provide a short-term loan equivalent to WP's estimated tax refund as well as a three-year term loan.

It is January 15, Year 7. You have been assigned to a team of specialists for this special engagement. A tax specialist will calculate WP's tax refund. A finance specialist will calculate the amount of the term loan WP might require in the next few years as a result of the lawsuit. As you begin your work, the partner on the review engagement of WP provides you with a list of the outstanding accounting issues related to the review engagement (see Exhibit Ill) and asks you to address them while working on your assignment.

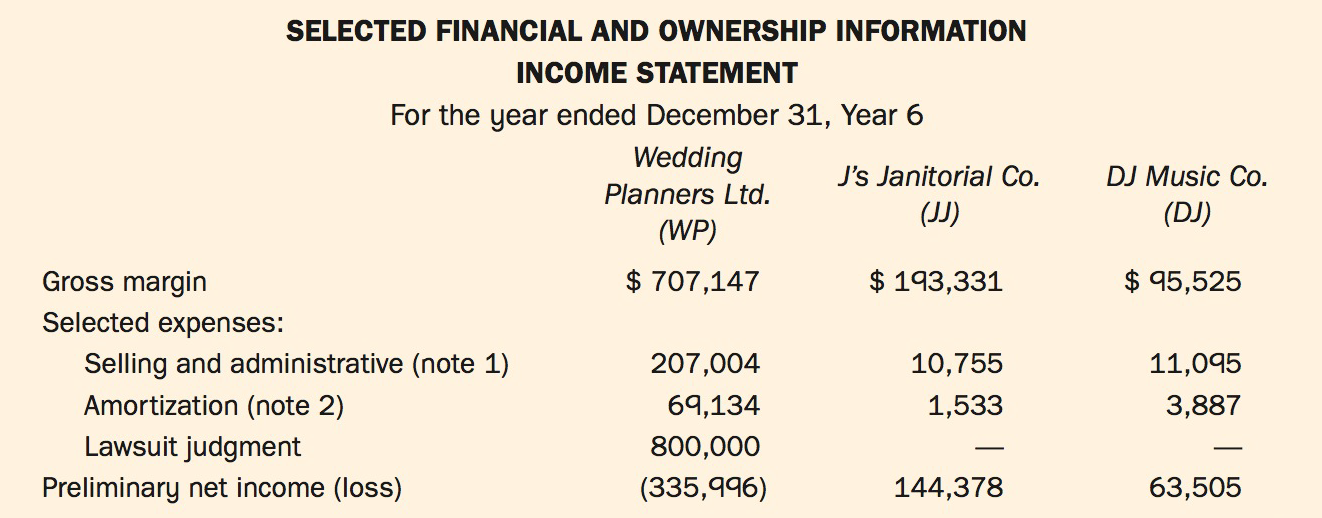

Exhibit Il:

Notes:

1. All employees are paid through WP. JJ and DJ have no payroll expense.

2. All companies use tax capital cost allowance (CCA) for accounting amortization purposes.

3. WP collects deposits from potential wedding customers. These deposits are recorded in revenue when received. At December 31, Year 5 and Year 6, there was $130,000 and $155,000, respectively, in deposits.

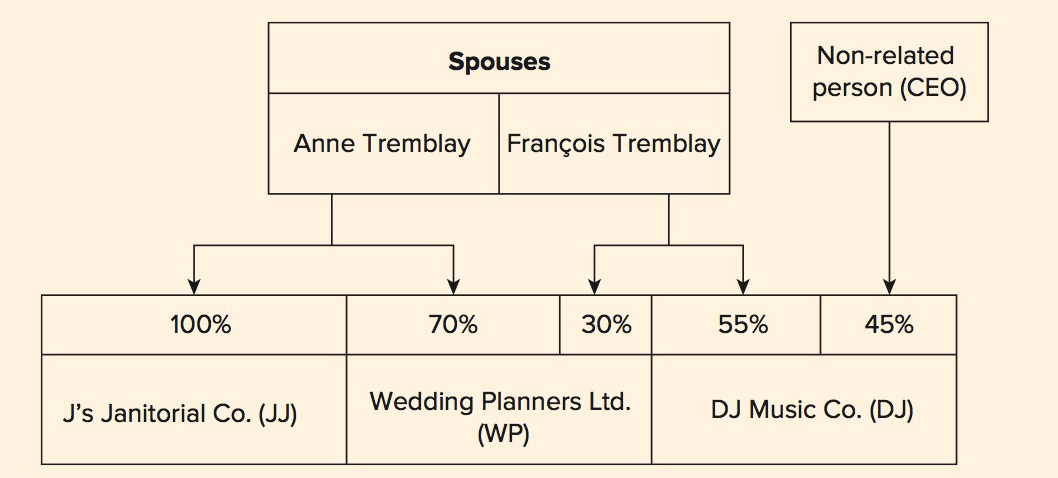

Organizational structure:

Dividends: During Year 6, JJ paid $70,000 in dividends.

Exhibit III:

OUTSTANDING ACCOUNTING ISSUES RELATED TO THE REVIEW ENGAGEMENT

Champagne

One of the most popu lar wedding alcohols is champagne. In January Year 4, Anne entered into a five-year fixed price contract at $360 per case to protect WP against market fluctuations. The champagne bought under the contract is recorded at the fixed price in the financial statements. During Year 6, Anne's decision appeared to be a good one, as the price of champagne continued to go up, hitting a high of $400 per case. However, at December 31, Year 6, the market price of one case of champagne is now down to $336. Anne heard that the price per case is expected to remain at this level or drop a bit more over the next two years. On December 31, Anne triggered the cancellation clause that allows WP to get out of the contract for $60,000. The payment was made January 2, Year 7. WP still has 60 cases on hand that were bought at $360.

As part of WP's efforts to retain good employees, Anne and Francois started giving deserving employees a case of champagne as a reward for their hard work. Thus far, WP has given away 50 cases. The feedback from the employees has been extremely positive, so Anne and Francois are planning to formalize the program and give away 10 cases a month. The cost of the champagne given away thus far has been absorbed in cost of sales.

Lawsuit Judgment Appeal

WP's lawyer was unhappy with Anne and Francois for paying the lawsuit without consulting her, and she immediately launched an appeal. She recently sent a letter to WP stating she is positive that the $800,000 judgment against WP will be refunded, with interest, within two to three years, for the following reasons:

• Several breaches of protocol by both the plaintiffs' lawyer and the judge in the original court case have been identified.

• The guest who committed the negligent act, and who had originally left Canada to avoid charges, has returned to Canada.

• There has just been a similar case settled through appeal in a higher Canadian court where the defendant was refunded all of the original damages.

Anne and Francois have not had the opportunity to think about the repercussions of the letter.

Intercompany Transactions

During Year 6, the following transactions occurred between the companies:

- WP sold one of its vehicles, a van, to JJ. The van had a carrying amount of $55,000 and was sold to JJ. for its market value of $25,000. The loss on sale has been included in the gross margin of WP.

- JJ provides janitorial services to WP and DJ at its estimated cost. All of JJ's other customers are external and pay full market value for janitorial services. Had WP paid market value for JJ 's services in Year 6, its costs would have increased by $50,000.

- Occasionally, DJ req,uires alcohol for its own events and purchases it from WP at WP's cost. DJ pays around $15,000 per year for the alcohol from WP. This alcohol has a sale value at wedding receptions of $40,000.

- Anne Tremblay is the CEO of WP and JJ. Her salary is paid by WP.

- DJ has a shareholder agreement that states that no cash can be removed from the company without the written consent of all shareholders. The CEO of DJ has stated that he does not want to remove the cash from the company, so Francois has never broached the matter.

Step by Step Answer:

Modern Advanced Accounting in Canada

ISBN: 978-1259087554

8th edition

Authors: Hilton Murray, Herauf Darrell