Question: 10.2 Consider the purchase of a new milling machine. What purchase price makes the NPV of the project zero? Base your analysis on the following

10.2 Consider the purchase of a new milling machine. What purchase price makes the NPV of the project zero? Base your analysis on the following facts.

n The new milling machine will reduce operating expenses by exactly £20,000 per year for 10 years. Each of these cash fl ow reductions takes place at the end of the year.

n The old milling machine is now 5 years old, and has 10 years of scheduled life remaining.

n The old milling machine was purchased for £45,000, and has a current market value of

£20,000.

n There are no taxes or infl ation.

n The risk-free rate is 6 per cent.

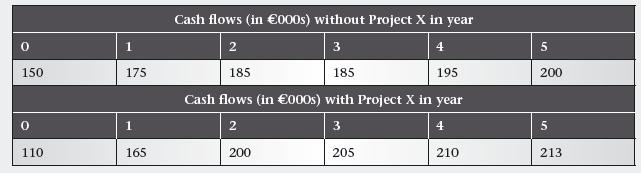

0 1 150 175 Cash flows (in 000s) without Project X in year 2 185 3 185 4 5 195 200 Cash flows (in 000s) with Project X in year 3 0 1 2 4 5 110 165 200 205 210 213

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts