This exercise explores the properties of two recently proposed riskiness indices: the Aumann and Serrano (AS 2008)

Question:

This exercise explores the properties of two recently proposed riskiness indices: the Aumann and Serrano (AS 2008) index and the Foster and Hart (FH 2009) index.

A decision maker is characterized by an initial wealth level \(W_{0}\) and von NeumannMorgenstern utility function \(u\) over wealth with \(u^{\prime}>0\) and \(u^{\prime \prime}u\left(W_{0}ight)\). We only consider gambles with \(\mathrm{E}[g]>0\) and \(\operatorname{Pr}(g0\). For simplicity, we assume that gambles take finitely many values. Let \(L_{g} \equiv \max (-g)\) and \(M_{g} \equiv \max g\) denote the maximal loss and maximal gain of \(g\), respectively.

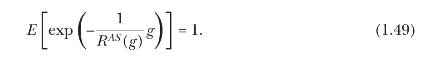

For any gamble \(g\), the AS riskiness index \(R^{A S}(g)\) is given by the unique positive solution to the equation

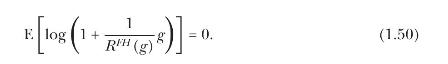

For any gamble \(g\), the FH riskiness \(R^{F H}(g)\) index is given by the unique positive solution to the equation

(a) Show that the AS riskiness index equals the level of risk tolerance that makes a CARA investor indifferent between accepting and rejecting the gamble. That is, an investor with CARA utility \(u(w)=-\exp (-A w)\) will accept (reject) \(g\) if \(A

(b) Show that the FH riskiness index equals the level of wealth that would make a log utility investor indifferent between accepting and rejecting the gamble. That is, a \(\log\) investor with wealth \(W_{0}>R^{F H}(g)\left(W_{0} \leq R^{F H}(g)ight)\) will accept (reject) \(g\).

(c) Consider binary gambles with a loss of \(L_{g}\) with probability \(p_{L}\) and a gain \(M_{g}\) with probability \(1-p_{L}\). Calculate the values of the two indices for the binary gamble with \(L_{g}=\$ 100, M_{g}=\$ 105\), and \(p_{L}=1 / 2\) (Rabin 2000). Repeat for the binary gamble with \(L_{g}=\$ 100, M_{g}=\$ 10,100\), and \(p_{L}=1 / 2\). (The calculation is analytical for \(\mathrm{FH}\) but numerical for AS.)

(d) Consider binary gambles with infinite gain, that is, \(M_{g}\) arbitrarily large. Derive explicit formulas for the two indices as a function of \(L_{g}\) and \(p_{L}\) at the limit \(M_{g} ightarrow+\infty\). Explain the intuition behind these formulas. Why do the indices assign nonzero riskiness to gambles with infinite expectation? What happens as \(p_{L} ightarrow 0\) ?

(e) The Sharpe ratio, defined as the ratio of the mean of a gamble to its standard deviation, \(S R(g) \equiv \mathrm{E}[g] / \sqrt{\operatorname{Var}(g)},{ }^{3}\) is a widely used measure of risk-adjusted portfolio returns. We can interpret its reciprocal as a riskiness index.

(i) Show by example that the (inverse) Sharpe ratio violates first-order stochastic dominance (and hence second-order stochastic dominance). That is, if gamble \(h\) first-order stochastically dominates gamble \(g\), then it is not always true that \(S R(h) \geq S R(g)\).

(ii) AS (2008) propose a generalized version of the Sharpe ratio \(\operatorname{GSR}(g) \equiv \mathrm{E}[g] /\) \(R^{A S}(g)\), a measure of "riskiness-adjusted" expected returns. Argue that GSR respects second-order stochastic dominance (and hence first-order stochastic dominance).

(iii) Show that \(\operatorname{GSR}(g)\) is ordinally equivalent to \(S R(g)\) when \(g\) is a normally distributed gamble.

Hint: use the probability density function of the normal distribution to show that \(R^{A S}(g)=\operatorname{Var}(g) /(2 \mathrm{E}[g])\).

Step by Step Answer:

Financial Decisions And Markets A Course In Asset Pricing

ISBN: 9780691160801

1st Edition

Authors: John Y. Campbell