This question asks you to analyze a simple model that formalizes the case for consumer financial regulation.

Question:

This question asks you to analyze a simple model that formalizes the case for consumer financial regulation. The model assumes that a fraction \(b\) of consumers are "behavioral" agents who make mistakes in using financial products, while the remaining consumers are rational. If a regulator cannot affect the choices of behavioral agents without distorting the choices of rational agents, regulation involves a tradeoff between benefits to behavioral agents and costs to rational agents.

Specifically, there are two financial products, \(A\) and \(B\). Product \(A\) delivers utility normalized to zero for all consumers: \(U_{A}=0\). Product \(B\) is correctly preferred by some consumers but mistakenly chosen by others.

A continuum of agents, with mass normalized to one, believe that they receive nonnegative utility \(U_{B}=u\) from product \(B .^{18} u\) is uniformly distributed across agents from 0 to an upper bound \(h\), and each agent knows her own value of \(u\). At each level of \(u\), a fraction \(b\) of the agents are behavioral agents who actually receive lower utility from the product, \(U_{B}=u-1\). The remaining fraction \((1-b)\) of the agents are rational and receive utility \(u\) as they expect.

(a) Regulatory charge. Suppose that a paternalistic regulator imposes a charge \(c\) on product \(B\), inducing all agents with \(u \leq c\) to switch to product \(A\). The revenue from the charge is rebated to agents in a lump sum. The regulator maximizes the integral of true utility (not self-perceived utility) across all agents. You may assume that \(c \leq h\).

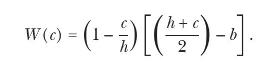

(i) Show that social welfare can be written as

(ii) Use this to show that a zero charge is never optimal unless all agents are rational.

(iii) What is the optimal charge \(c\) and by what proportion does it shrink the market for product \(B\) ? Explain intuitively how the optimal charge and the shrinkage of the market depend on the parameters \(b\) and \(h\).

(b) Regulatory charge with deadweight cost. Now suppose that the regulatory charge imposes deadweight cost on the financial system. A fraction \(\alpha\) of the regulatory charge cannot be rebated.

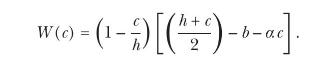

(i) Show that social welfare can be written as

(ii) State conditions for the problem to be convex. (Hint: check the second derivative of the social welfare function.) Under these conditions, what is the optimal charge \(c\) ? How does it depend on the parameters \

(b, h\), and \(\alpha\) ? For what parameter values is it larger or smaller than in part (a)? Explain.

(iii) Discuss optimal policy if the problem is not convex.

(c) Regulatory charge with mistake mitigation. Now assume that product \(B\) is not inherently unsuitable for behavioral consumers, and the regulatory charge can reduce the utility loss to these consumers from 1 to \(1-\theta c\) for \(c \leq 1 / \theta\).

(i) Show that the social welfare function takes the same form as in part

(b) but replacing the parameter \(\alpha\) with \(\alpha^{*}=\alpha-b \theta\).

(ii) In this case, \(\alpha^{*}\) can be negative. Show that if it is, then the effect of \(h\) on the optimal regulatory charge has the opposite sign from the one derived in part (b). Explain.

Step by Step Answer:

Financial Decisions And Markets A Course In Asset Pricing

ISBN: 9780691160801

1st Edition

Authors: John Y. Campbell