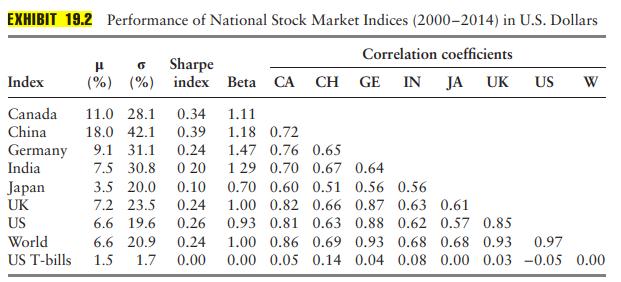

The MSCI world stock market index in Exhibit 19.2 had a mean annual return of 6.6 percent

Question:

The MSCI world stock market index in Exhibit 19.2 had a mean annual return of 6.6 percent and a standard deviation of 29.9 percent. Meanwhile, dollar returns to 10-year U.S. treasuries had a mean return of 2.3 and a standard deviation of 6.6 percent. The correlation between these two indices was –0.24. Calculate the mean and standard deviation of an equal-weighted portfolio of global stocks and U.S. 10-year T-bonds. Also, calculate the Sharpe index for this stock–bond portfolio using the historical 1.5 percent mean return on U.S. T-bills.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: