In economics, the Laffer curve is an economic model named after Arthur Laffer, but it actually dates

Question:

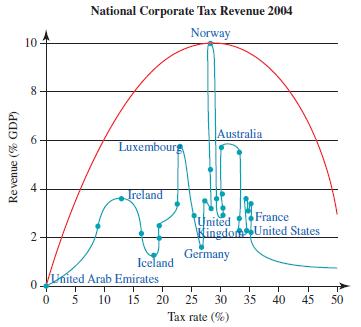

In economics, the Laffer curve is an economic model named after Arthur Laffer, but it actually dates back to the 14th-century Muslim philosopher Ibn Khaldun. The Laffer curve postulates that no tax revenue will be raised at the extreme tax rates of \(0 \%\) and \(100 \%\). If both \(0 \%\) and \(100 \%\) rates generate no revenue, but some intermediate tax rate generates some tax revenue, then it follows (from a theorem in calculus) that there must exist at least one tax rate where tax revenue would be a nonzero maximum. Figure 15.26 is the result of a study done in 2004 .

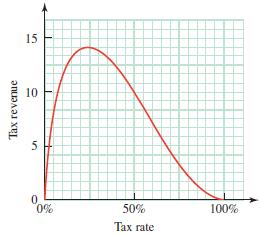

Suppose a Laffer curve can be represented by the equation \[y=-0.004 x^{2}+0.4 x\]

where \(x\) is the tax rate and \(y\) is the revenue as a percent of gross domestic product (GDP).

a. Graph the Laffer curve whose equation is given.

b. If the tax rate is \(0 \%, 25 \%, 50 \%, 75 \%\), or \(100 \%\), what is the tax revenue (as a percent of GDP)?

c. If the tax revenue is given as a percent of the GDP for the Laffer curve shown in Figure 15.27, what tax rate will maximize tax revenue?

Figure 15.27

Step by Step Answer: