The Cascades Swim Club has 300 shareholders, each holding one share of stock in the club. A

Question:

However, during the past winter two events occurred that have suddenly increased the demand for shares in the club. The winter was especially severe, and subzero weather and heavy ice storms caused both the town and the regional pools to buckle and crack. The problems were not discovered until maintenance crews began to prepare the pools for the summer, and repairs cannot be completed until the fall. Also during the winter, the manager of the local country club had an argument with her board of directors and one night burned down the clubhouse. Although the pool itself was not damaged, the dressing room facilities, showers, and snack bar were destroyed. As a result of these two events, the Cascades Swim Club was inundated with applications to purchase shares. The waiting list suddenly grew to 250 people as the summer approached.

The board of directors of the swim club had refrained from issuing new shares in the past because there never was a very great demand, and the demand that did exist was usually absorbed within a year by stock turnover. In addition, the board has a real concern about overcrowding. It seemed like the present membership was about right, and there were very few complaints about overcrowding, except on holidays such as Victoria Day and Canada Day. However, at a recent board meeting a number of new applicants had attended and asked the board to issue new shares. In addition, a number of current shareholders suggested that this might be an opportunity for the club to raise some capital for needed repairs and to improve some of the existing facilities. This was tempting to the board. Although it had set the share price at $500 in the past, the board could set it at a much higher level now. In addition, an increase in attendance could create a need for more lifeguards.

Before the board of directors could make a decision on whether to sell more shares and, if so, how many, the board members felt they needed more information. Specifically, they would like a forecast of the average number of people (family members, guests, etc.) who might attend the pool each day during the summer with the current number of shares.

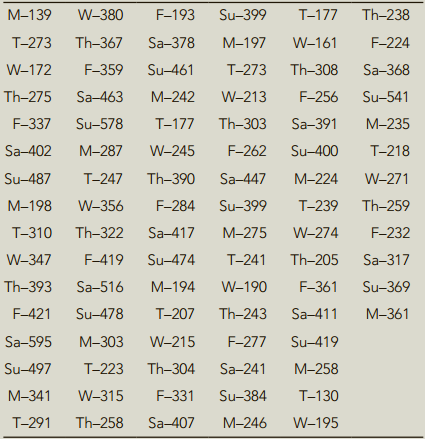

The board of directors has the following daily attendance records for June through August from the previous summer; it thinks the figures would provide accurate estimates for the upcoming summer.

Develop a forecasting model to forecast daily demand during the summer.

Step by Step Answer:

Operations Management Creating Value Along the Supply Chain

ISBN: 978-1118301173

1st Canadian Edition

Authors: Roberta S. Russell, Bernard W. Taylor, Ignacio Castillo, Navneet Vidyarthi