Christensen Ranch operates in Pennsylvania. Calculate the state income tax for each employee using the state income

Question:

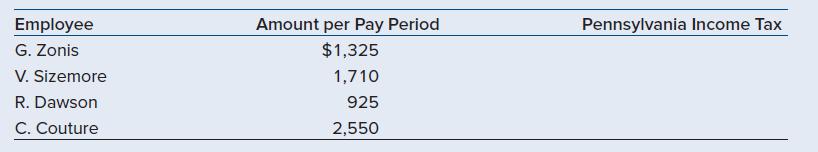

Christensen Ranch operates in Pennsylvania. Calculate the state income tax for each employee using the state income tax rate of 3.07 percent. Assume that no pre-tax deductions exist for any employee.

Transcribed Image Text:

Employee G. Zonis V. Sizemore R. Dawson C. Couture Amount per Pay Period $1,325 1,710 925 2,550 Pennsylvania Income Tax

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (18 reviews)

To calculate the Pennsylvania income tax for each employee we need to mul...View the full answer

Answered By

Dulal Roy

As a tutor, I have gained extensive hands-on experience working with students one-on-one and in small group settings. I have developed the ability to effectively assess my students' strengths and weaknesses, and to customize my teaching approach to meet their individual needs.

I am proficient at breaking down complex concepts into simpler, more digestible pieces, and at using a variety of teaching methods (such as visual aids, examples, and interactive exercises) to engage my students and help them understand and retain the material.

I have also gained a lot of experience in providing feedback and guidance to my students, helping them to develop their problem-solving skills and to become more independent learners. Overall, my hands-on experience as a tutor has given me a deep understanding of how to effectively support and encourage students in their learning journey.

0.00

0 Reviews

10+ Question Solved

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted:

Students also viewed these Business questions

-

Christensen Ranch operates in Pennsylvania. Using the state income tax rate of 3.07%, calculate the state income tax for each employee.

-

Fannons Chocolate Factory operates in North Carolina. Calculate the state income tax for each employee using the state income tax rate of 4.99 percent. Assume that no pre-tax deductions exist for any...

-

Compute the Federal income tax withholding for each employee using the percentage method in Appendix C. Assume that no pre-tax deductions exist for any employee. (Round your intermediate calculations...

-

Preparing and interpreting a statement of cash flows using a T-account work sheet. Financial statement data for Dickerson Manufacturing Company for the current year appear in Exhibit 5.29. Additional...

-

Refer to the data in Exercise 7. 18. When the capacity of the HR Department was originally established, the normal usage expected for each department was 20,000 direct labor hours. This usage is also...

-

The ability of a firm to consistently outperform its rivals is called ____________. (a) vertical integration (b) competitive advantage (c) incrementalism (d) strategic intent

-

\(X\) is the number of bits in error in the next four bits transmitted. What is the expected value of the square of the number of bits in error? Now, \(h(X)=X^{2}\). Therefore, \[ \begin{aligned}...

-

On June 30, Danver Limited issues 5%, 20-year bonds payable with a face value of $120,000. The bonds are issued at 94 and pay interest on June 30 and December 31. Requirements 1. Journalize the...

-

Need to calculate payback period for each project Project A Year 0 - $-8,000,000 Year 1 - $4,000,000 Year 2 - $2,500,000 Year 3 - $2,500,000 Project B Year 0 - $-4,250,000 Year 1 - $1,500,000 Year 2...

-

Prevosti Farms and Sugarhouse pays its employees according to their job classification. The following employees make up Sugarhouse's staff: Employee Number Name and Address Payroll information...

-

Which of the following is true about employee pay methods? a. Employees must be able to access the full amount of their net pay on the pay date. b. Employers must keep a record of all pay...

-

The owner of All Grains Bakery is considering offering additional payroll disbursal methods for the employees. Which of the following would be the safest for employees without a bank account? a....

-

What changes to the business environment strengthened the need for consumer protection legislation?

-

Provide a description best explains the process of enriching foods?

-

Ramon is approved for a 8 year loan of 45,000 at nominal rate of interest convertible semiannually of 8.2432 percent. making monthly payments at the end of each month. a. What is his monthly payment?...

-

a) How many sheg are there in 7.96 bruck? b) How many whid are there in 2.98 chab? c) How many bruck are there in 1.25 chab? d) How many sheg are there in 1.86 stot/whid? e) How many sheg/bruck are...

-

You expect a share of Econ News.Com to sell for $65 a year from now. If you are willing to pay $60.38 for one share of the stock today, and you expect a dividend payment of $2.00, what rate of return...

-

Your clients have decided to convert their unfinished basement into living space which will include a recreation room, a bedroom, a full bath, and an office. Other than a small space housing the...

-

The resumes of 2 male applicants for a college teaching position in chemistry are placed in the same file as the resumes of 2 female applicants. Two positions become available and the first, at the...

-

In a system with light damping (c < cc), the period of vibration is commonly defined as the time interval d = 2/d corresponding to two successive points where the displacement-time curve touches one...

-

How did data governance improve operations and management decision making?

-

What business benefits did the companies and services described in this case achieve by analyzing and using big data.

-

Identify two decisions at the organizations described in this case that were improved by using big data, and two decisions that were not improved by using big data.

-

Spritzer Inc. summarized the following pretax amounts from its accounting records for the year: income before income taxes, $144,000; foreign currency translation adjustment, $4,000; unrealized loss...

-

2. Use the data below to answer the questions: 10 points each Sales Price Per Unit Variable Cost Per Unit Fixed Costs Target Profit a. What is the per unit contribution margin? 40 20 20,000 500,000...

-

The Crowne Plaza in Kitchener has 238 rooms and achieved an occupancy of 68% for 2023 with an average daily rate of $158.76. They anticipate growth of 8% in occupancy for 2024 with no change in their...

Study smarter with the SolutionInn App