For the Critical Thinking problems, use the following steps to compute the gross-up amount: 1. Compute tax

Question:

For the Critical Thinking problems, use the following steps to compute the gross-up amount:

1. Compute tax rate: The tax rate on bonuses is 22 percent. Social Security (6.2 percent) and Medicare taxes (1.45 percent) must be added to this rate. For bonuses, the total tax rate equals 22% + 6.2% + 1.45%, or 29.65%.

2. Subtract 100 percent – tax rate percentage to get the net tax rate. For bonuses, it is 100% – 29.65%, or 70.35%.

3. Gross-up amount = net pay / net tax rate. For example, if you want the employee to receive a $150 bonus, the equation is $150/70.35% = $213.22.

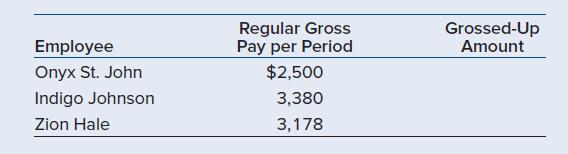

Your boss approaches you in mid-December and requests that you pay certain employees their gross pay amount as if there were no deductions as their year-end bonuses. None of the employees have reached the Social Security wage base for the year and the company pays semimonthly. What is the gross-up amount for each of the following employees?

Step by Step Answer:

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer