Parker is the concierge at the Trans-Canada Resort in Michigan. Parker is single with one other dependent

Question:

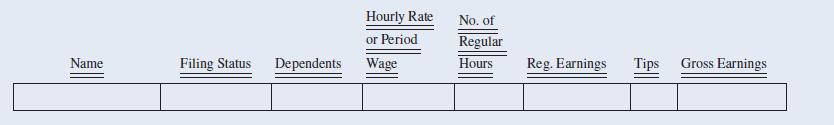

Parker is the concierge at the Trans-Canada Resort in Michigan. Parker is single with one other dependent and receives the standard tipped hourly wage for the state. During the week ending June 4, Parker worked 40 hours and received $105 in tips. Compute Parker’s pay for the period.

Does the Trans-Canada Resort need to contribute to Parker’s wages to meet FLSA minimum wage requirements? _____

If so, how much must the employer contribute? _____

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Payroll Accounting 2023

ISBN: 9781264415618

9th Edition

Authors: Jeanette M. Landin, Paulette Schirmer

Question Posted: