Question: a. Rick is a waiter at Palace Eats in Delaware. He is single with 1 withholding allowance.He receives the standard tipped hourly wage.During the week

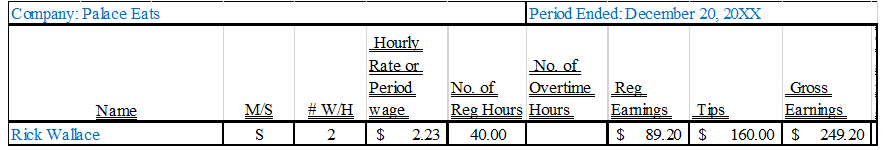

a. Rick is a waiter at Palace Eats in Delaware. He is single with 1 withholding allowance.He receives the standard tipped hourly wage.During the week ending October 20, 20XX, he worked 40hoursand he received $160 in tips. Calculate the following:

b. How much does Palace Eats need to contribute to Rick€™s wages to meet FLSA requirements?

Period Ended: December 20, 20XX Company: Palace Eats Hourly Rate or No. of No. of Reg Hours Hours Overtime Reg Eamings Period # WH wage Gross Tips Earnings M/S Name Rick Walace 2.23 89.20 | $ 160.00 $ 40.00 249.20 %24

Step by Step Solution

3.20 Rating (161 Votes )

There are 3 Steps involved in it

a Ricks wages for the week hourly rate hours 89... View full answer

Get step-by-step solutions from verified subject matter experts