Question:

Use Worksheet 11.2 to help Becky and Travis Hoffmeister, a married couple in their early 30s, evaluate their securities portfolio, which includes these holdings.

a. Walt Disney Co. (NYSE; symbol, DIS): 100 shares bought in December 1997 for $28.90 per share. (The stock had a 3-for-1 split in 1998, so the Hoffmeisters now own 300 shares of DIS.)

b. Bank of America (NYSE; symbol, BAC): 250 shares purchased in December 1998 for $19.37 per share. (The stock had a 2-for-1 split in 2004, so the Hoffmeisters now own 500 shares of BAC.)

c. Oracle (NASDAQ; symbol, ORCL): 150 shares purchased in 2000 at $21.50 per share. (The stock has since had two 2-for-1 splits, so the Hoffmeisters now own 600 shares of ORCL.)

d. Exxon Mobil (NYSE; symbol, XOM): 200 shares purchased in 2001 at $37.21 per share. (The stock had a 2-for-1 split in 2001, so the Hoffmeisters now own 400 shares of XOM.)

e. The Hoffmeisters also have $8,000 in a 3-year bank CD that pays 2.63% annual interest.

1. Based on the latest quotes obtained from The Wall Street Journal (or elsewhere), complete Worksheet 11.2.

2. What’s the total amount the Hoffmeisters have invested in these securities, the annual income they now receive, and the latest market value of their investments?

Transcribed Image Text:

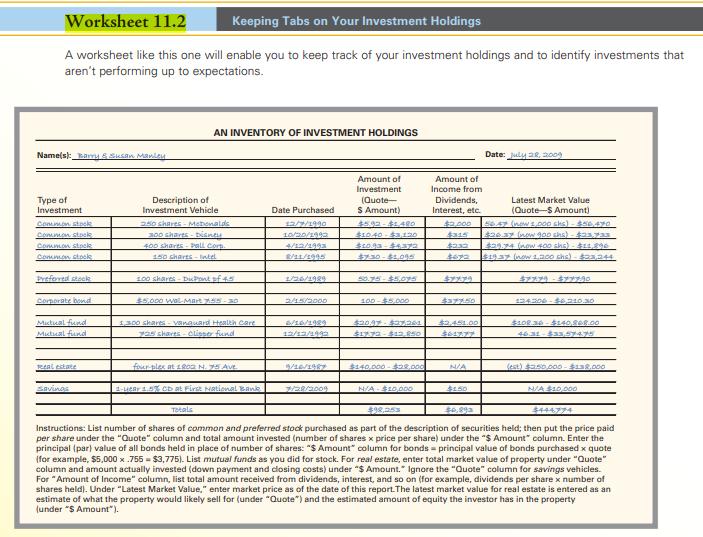

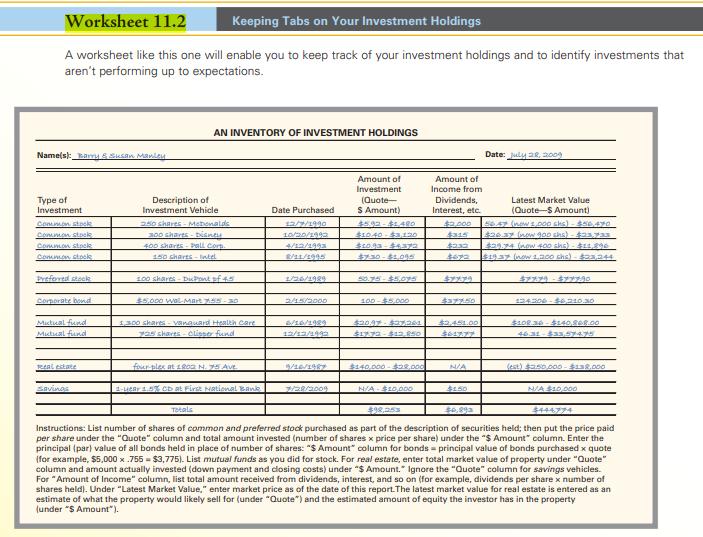

Worksheet 11.2 Keeping Tabs on Your Investment Holdings A worksheet like this one will enable you to keep track of your investment holdings and to identify investments that aren't performing up to expectations. AN INVENTORY OF INVESTMENT HOLDINGS Name(s): Barry & Susan Manley Common stock Type of Investment Common stock Common stock Common stocke Description of Investment Vehicle 250 shares-McDonalds 300 sharts Disney 400 shares Pall Corp. 150 sharts-Intel Date Purchased 12/7/1990 10/20/1992 4/12/1993 8/11/1995 $10.40 $3,130 $2,000 $315 $10.93-$4372 $7.30-$1,095 $232 $672 Preferred stock 100 shares-DuPont of 4.5 1/26/1989 50.75-$5.075 $7779 Corporate bond $5,000 Wal-Mart 7:55-30 2/15/2000 100-$5,000 $37750 Mutual fund Mutual fund 1,300 shares-vanguard Health Care 725 shares Clisser fund 6/16/1989 12/12/1992 $20.97 $27261 $17.72-$43.850 $2,451.00 $61977 Amount of Investment (Quote- $ Amount) $5.92-$1480 Amount of Income from Dividends, Interest, etc. Date: July 28, 2009 Latest Market Value (Quote-$ Amount) 56.47 (now 1,000 shs)-$46.470 $20.37 (now 900 shs) - $23,733 $29.74 (now 400 shs) - $11,896 $1937 (now 1.200 shs)-$23,244 $7779-577790 124306-$60.210.30 $108.30-$140,868.00 46.31-$33,57475 Real estate four-ples at 1802 N. 75 Ave 19/10/1987 $140,000-$22.000 N/A (est) $250,000-$138.000 Savings 1-year 1.5% CD at First National Bank 7/28/2009 N/A $10,000 $150 Totals $98,25 $0.893 N/A $10,000 $444774 Instructions: List number of shares of common and preferred stock purchased as part of the description of securities held; then put the price paid per share under the "Quote" column and total amount invested (number of shares x price per share) under the "$ Amount" column. Enter the principal (par) value of all bonds held in place of number of shares: "$ Amount" column for bonds principal value of bonds purchased x quote (for example, $5,000 x .755 $3,775). List mutual funds as you did for stock. For real estate, enter total market value of property under "Quote" column and amount actually invested (down payment and closing costs) under "$ Amount. Ignore the "Quote" column for savings vehicles. For "Amount of Income" column, list total amount received from dividends, interest, and so on (for example, dividends per share x number of shares held). Under "Latest Market Value," enter market price as of the date of this report. The latest market value for real estate is entered as an estimate of what the property would likely sell for (under "Quote") and the estimated amount of equity the investor has in the property (under "$ Amount").