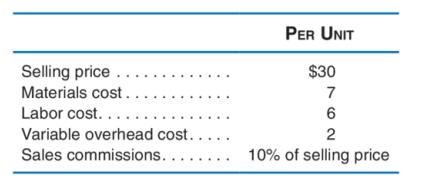

Pome Company produces a single product: the Core. The following table provides the Cores details. For the

Question:

Pome Company produces a single product: the Core. The following table provides the Core’s details.

For the upcoming year, Pome Company expects to sell 500,000 units of the Core, have total fixed costs of $4,500,000, and face a tax rate of 30% of income.

Required

(a) At the expected level of unit sales, what is the after-tax income?

(b) What is the breakeven unit sales of the Core?

(c) The marketing manager believes that if the Core’s price is cut by $2 unit, sales will increase by 10%. Is this change desirable from a financial perspective?

(d) Ignore part (c) when answering this question. The production manager believes that if Pome Company rents a new machine, total manufacturing variable costs (materials, labor, and overhead) per unit will each drop by 10%. What is the annual rent for this machine so that the income with this machine will equal the income in part (a)?

Step by Step Answer:

Management Accounting Information For Decision Making

ISBN: 9781618533517

7th Edition

Authors: Anthony A. Atkinson