CardioMed Inc. is a manufacturer of wearable heart monitoring products that automatically detect, record, and transmit abnormal

Question:

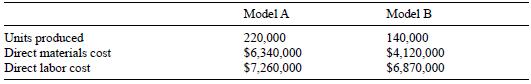

CardioMed Inc. is a manufacturer of wearable heart monitoring products that automatically detect, record, and transmit abnormal heart rhythms for up to thirty days. In one accounting period the firm produced in its plant in San Jose, California, 220,000 units of model A and 140,000 units of model B. The selling prices of models A and B are respectively $160 and $190, while the direct costs for the period are shown in the table below:

If total manufacturing overhead expenses for the same period have been equal to $14,460,000, what would be the unit cost and gross profit margin per model if the company uses an allocation rule based on:

(a) the proportion of each product over the total output (in units) and

(b) the proportion of direct labor costs used by each product. Which allocation basis do you think is more representative of the actual overhead consumption of the two models? Please explain briefly.

Step by Step Answer:

Practical Finance For Operations And Supply Chain Management

ISBN: 9780262043595

1st Edition

Authors: Alejandro Serrano, Spyros D. Lekkakos, James B. Rice