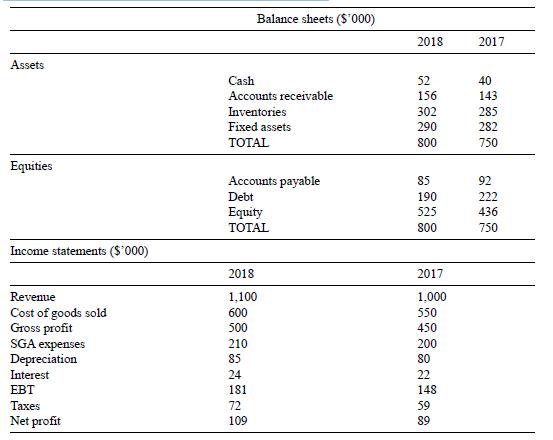

Given the following financial statements for a retailer firm: Inventories have been evaluated under LIFO assumption. Under

Question:

Given the following financial statements for a retailer firm:

Inventories have been evaluated under LIFO assumption. Under FIFO, inventories would be eighty and sixty higher in 2018 and 2017, respectively.

a. What would gross profit have been in 2018 had the firm used the FIFO assumption? Show your work.

b. How many taxes did the firm save in 2018 because of the LIFO assumption?

c. Under which method (FIFO or LIFO) is it easier to manipulate net profit? Why? What is/are the lever(s) managers have in order to do so?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Practical Finance For Operations And Supply Chain Management

ISBN: 9780262043595

1st Edition

Authors: Alejandro Serrano, Spyros D. Lekkakos, James B. Rice

Question Posted: