Question: In the Smart Widgets Inc. example in section 8.2.2 what would be the companys net operating profit had the firm produced 8,000 instead of 5,000

In the Smart Widgets Inc. example in section 8.2.2 what would be the company’s net operating profit had the firm produced 8,000 instead of 5,000 units? How does this compare with the current results?

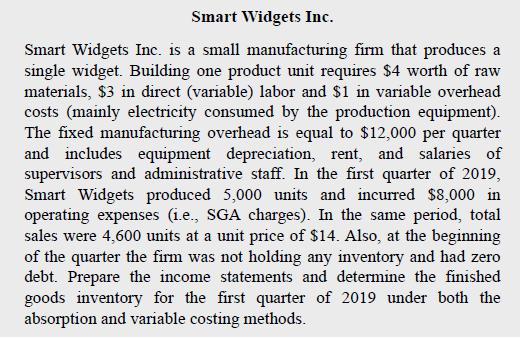

Smart Widgets Inc. Smart Widgets Inc. is a small manufacturing firm that produces a single widget. Building one product unit requires $4 worth of raw materials, $3 in direct (variable) labor and $1 in variable overhead costs (mainly electricity consumed by the production equipment). The fixed manufacturing overhead is equal to $12,000 per quarter and includes equipment depreciation, rent, and salaries of supervisors and administrative staff. In the first quarter of 2019, Smart Widgets produced 5,000 units and incurred $8,000 in operating expenses (i.e., SGA charges). In the same period, total sales were 4,600 units at a unit price of $14. Also, at the beginning of the quarter the firm was not holding any inventory and had zero debt. Prepare the income statements and determine the finished goods inventory for the first quarter of 2019 under both the absorption and variable costing methods.

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

ANSWER Illustration Smart Widgets Inc produces a single widget Raw materials cost 4 per unit Direct ... View full answer

Get step-by-step solutions from verified subject matter experts