Question: Make up an example, as described in the previous problem, with 20 possible investments. However, do it so the ROIs are in a very tight

Make up an example, as described in the previous problem, with 20 possible investments. However, do it so the ROIs are in a very tight range, such as from 12% to 13%. Then use Solver to find the optimal solution when the Solver Integer Optimality setting is 5%, and record the solution. Next, solve again with the setting at 0%. Do you get the same solution? Try this on a few more instances of the model, where you keep changing the inputs. The question is whether the Integer Optimality setting matters in these types of "close call" problems.

Data from Previous Problem:

Expand and then solve the capital budgeting model in Figure 6.5 so that 20 investments are now possible. You can make up the data on cash requirements, NPVs, and the budget, but use the following guidelines:

- The cash requirements and NPVs for the various investments can vary widely, but the ROIs should be between 10% and 15% for each investment.

- The budget should allow somewhere between 5 and 10 of the investments to be selected.

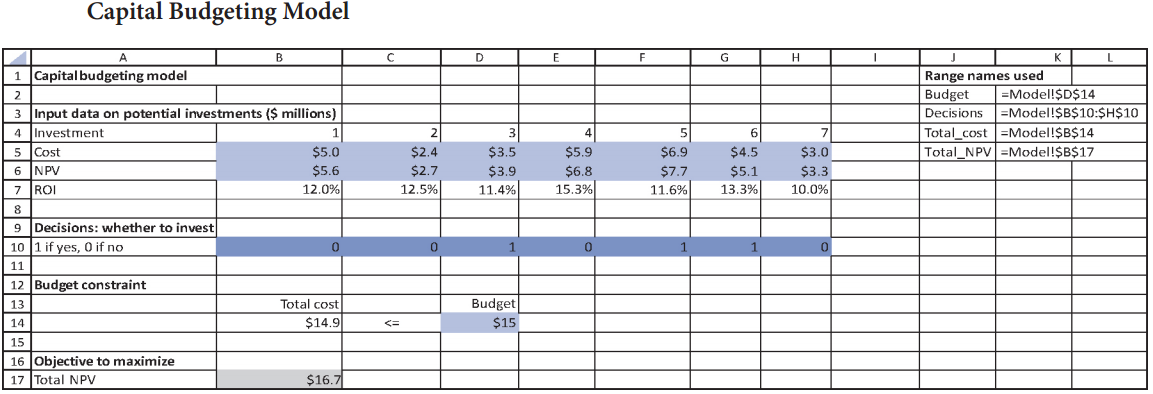

Figure 6.5:

Capital Budgeting Model G. 1 Capital budgeting model Range names used Budget Decisions =Model!$B$10:$H$10 Total_cost=Model!$B$14 Total_NPV=Model!$B$17 =Model!$D$14 3 Input data on potential investments ($ millions) 4 Investment 5 |Cost 2 $2.4 $2.7 12.5% 3 $3.5 $3.9 11.4% 4 $6.9 $4.5 $5.9 $6.8 15.3% $5.0 $5.6 $3.0 $3.3 10.0% 6 NPV 7 ROI $7.7 $5.1 13.3% 12.0% 11.6% 9 Decisions: whether to invest 10 1 if yes, 0 if no 11 1. 12 Budget constraint Total cost $14.9 13 14 Budget $15 15 | 16 Objective to maximize | 17 Total NPV $16.7

Step by Step Solution

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Capital budgeting model Input data on potential in... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (3 attachments)

1497_60b74124a6c9c_696611.pdf

180 KBs PDF File

1497_60420a1b60993_696611.xlsx

300 KBs Excel File

1497_60b74124a6c9c_696611.docx

120 KBs Word File