Question: Alexi files her tax return 41 days after the due date. Along with the return, she remits a check for $14,700, which is the

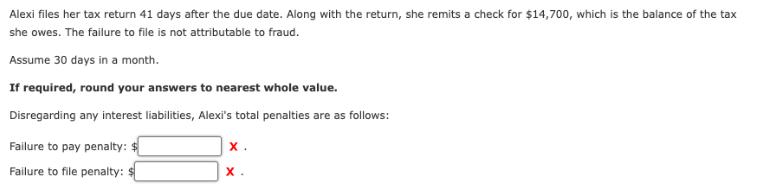

Alexi files her tax return 41 days after the due date. Along with the return, she remits a check for $14,700, which is the balance of the tax she owes. The failure to file is not attributable to fraud. Assume 30 days in a month. If required, round your answers to nearest whole value. Disregarding any interest liabilities, Alexi's total penalties are as follows: Failure to pay penalty: $ Failure to file penalty: x. x.

Step by Step Solution

There are 3 Steps involved in it

To calculate the penalties for Alexis late tax return 1 Failure to Pay Penalty This penalty ... View full answer

Get step-by-step solutions from verified subject matter experts