One method of pricing a stock is to discount the stream of future dividends of the stock.

Question:

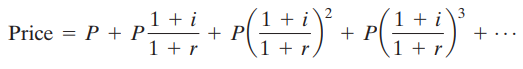

One method of pricing a stock is to discount the stream of future dividends of the stock. Suppose that a stock pays per year in dividends and, historically, the dividend has been increased i% per year. If you desire an annual rate of return of r%, this method of pricing a stock states that the price that you should pay is the present value of an infinite stream of payments:

The price of the stock is the sum of an infinite geometric series. Suppose that a stock pays an annual dividend of $4.00 and, historically, the dividend has been increased 3% per year. You desire an annual rate of return of 9%. What is the most you should pay for the stock?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: