Question: Are Smiths two comments about his analysis correct? A. Both of his comments are correct. B. Both of his comments are incorrect. C. His first

Are Smith’s two comments about his analysis correct?

A. Both of his comments are correct.

B. Both of his comments are incorrect.

C. His first comment is correct, and his second comment is incorrect.

Kinetic Corporation is considering acquiring High Tech Systems. Jim Smith, the vice president of finance at Kinetic, has been assigned the task of estimating a fair acquisition price for High Tech. Smith is aware of several approaches that could be used for this purpose. He plans to estimate the acquisition price based on each of these approaches, and has collected or estimated the necessary financial data.

High Tech has 10 million shares of common stock outstanding and no debt. Smith has estimated that the post-merger free cash flows from High Tech, in millions of dollars, would be 15, 17, 20, and 23 at the end of the following four years. After Year 4, he projects the free cash flow to grow at a constant rate of 6.5 percent a year. He determines that the appropriate rate for discounting these estimated cash flows is 11 percent. He also estimates that after four years High Tech would be worth 23 times its free cash flow at the end of the fourth year.

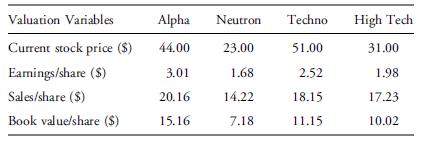

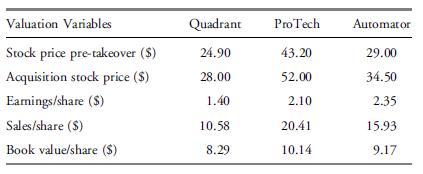

Smith has determined that three companies—Alpha, Neutron, and Techno—are comparable to High Tech. He has also identified three recent takeover transactions—Quadrant, ProTech, and Automator—that are similar to the takeover of High Tech under consideration.

He believes that price-to-earnings, price-to-sales, and price-to-book value per share of these companies could be used to estimate the value of High Tech. The relevant data for the three comparable companies and for High Tech are as follows:

The relevant data for the three recently acquired companies are given below:

While discussing his analysis with a colleague, Smith makes two comments. Smith’s first comment is: “If there were a pre-announcement run-up in Quadrant’s price because of speculation, the takeover premium should be computed based on the price prior to the runup.”

His second comment is: “Because the comparable transaction approach is based on the acquisition price, the takeover premium is implicitly recognized in this approach.”

Valuation Variables Alpha Neutron Techno High Tech Current stock price ($) 44.00 23.00 51.00 31.00 Earnings/share ($) 3.01 1.68 2.52 1.98 Sales/share ($) 20.16 14.22 18.15 17.23 Book value/share ($) 15.16 7.18 11.15 10.02

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Lets evaluate Smiths two comments Smiths first comment If there were a preannouncement runup in Quad... View full answer

Get step-by-step solutions from verified subject matter experts