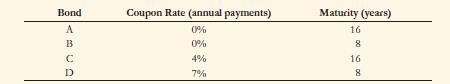

Consider the following bonds: a. What is the percentage change in the price of each bond if

Question:

Consider the following bonds:

a. What is the percentage change in the price of each bond if its yield to maturity falls from 6% to 5%?

b. Which of the bonds A–D is most sensitive to a 1% drop in the interest rates from 6% to 5%

and why? Which bond is least sensitive? Provide an intuitive explanation for your answer.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: