Look at Table 27.1. a. How many Japanese yen do you get for your dollar? b. What

Question:

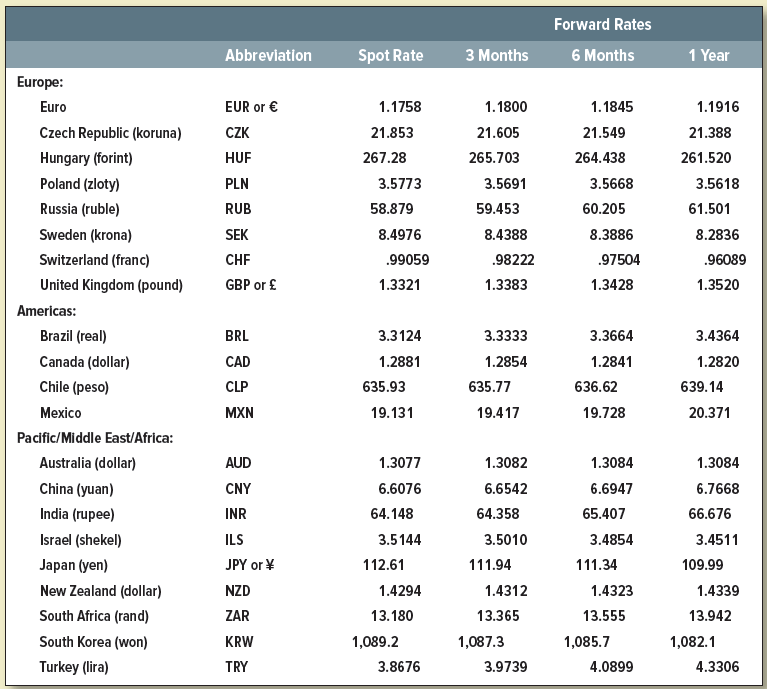

Look at Table 27.1.

a. How many Japanese yen do you get for your dollar?

b. What is the three-month forward rate for yen?

c. Is the yen at a forward discount or premium on the dollar?

d. Use the one-year forward rate to calculate the annual percentage discount or premium on yen.

e. If the one-year interest rate on dollars is 2.5% annually compounded, what do you think is the one-year interest rate on yen?

f. According to the expectations theory, what is the expected spot rate for yen in three months? time?

g. According to purchasing power parity theory, what then is the expected difference in the three-month rate of price inflation in the United States and Japan?

Table 27.1

Step by Step Answer:

Principles of Corporate Finance

ISBN: 978-1260013900

13th edition

Authors: Richard Brealey, Stewart Myers, Franklin Allen