Question: Net present value You are considering a 4-year project that has the following pro forma statement: In addition, you have estimated the project will require

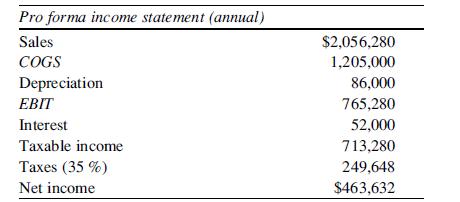

Net present value You are considering a 4-year project that has the following pro forma statement:

In addition, you have estimated the project will require an increase in net capital spending of $1.8 million and an increase in net working capital of $450,000. If the firm’s WACC is 8 %, what is the net present value? Should you accept or reject?

Pro forma income statement (annual) Sales $2,056,280 COGS 1,205,000 Depreciation 86,000 EBIT Interest Taxable income Taxes (35%) Net income 765,280 52,000 713,280 249,648 $463,632

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock