Sandell is interested in the weighted average cost of capital of Kruspa AB prior to its investing

Question:

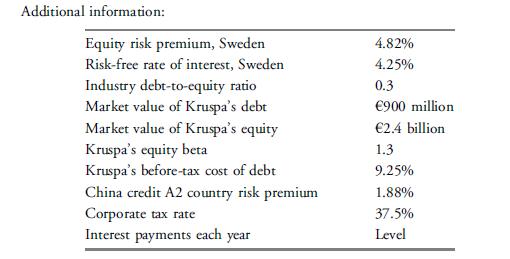

Sandell is interested in the weighted average cost of capital of Kruspa AB prior to its investing in the China project. This weighted average cost of capital (WACC) is closest to:

A. 7.65%.

B. 9.23%.

C. 10.17%.

Jurgen Knudsen has been hired to provide industry expertise to Henrik Sandell, CFA, an analyst for a pension plan managing a global large-cap fund internally. Sandell is concerned about one of the fund’s larger holdings, auto parts manufacturer Kruspa AB. Kruspa currently operates in 80 countries, with the previous year’s global revenues at h5.6 billion. Recently, Kruspa’s CFO announced plans for expansion into China. Sandell worries that this expansion will change the company’s risk profile and wonders if he should recommend a sale of the position.

Sandell provides Knudsen with the basic information. Kruspa’s global annual free cash flow to the firm is h500 million and earnings are h400 million. Sandell estimates that cash flow will level off at a 2 percent rate of growth. Sandell also estimates that Kruspa’s aftertax free cash flow to the firm on the China project for next three years is, respectively, h48 million, h52 million, and h54.4 million. Kruspa recently announced a dividend of h4.00 per share of stock. For the initial analysis, Sandell requests that Knudsen ignore possible currency fluctuations. He expects the Chinese plant to sell only to customers within China for the first three years. Knudsen is asked to evaluate Kruspa’s planned financing of the required h100 million with a h80 public offering of 10-year debt in Sweden and the remainder with an equity offering.

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan