The most appropriate response to Chos question regarding the classification of risk arising from the mixture of

Question:

The most appropriate response to Cho’s question regarding the classification of risk arising from the mixture of variable and fixed costs is:

A. sales risk.

B. financial risk.

C. operating risk.

Mary Benn, CFA, is a financial analyst for Twin Fields Investments, located in Storrs, Connecticut, U.S.A. She has been asked by her supervisor, Bill Cho, to examine two small Japanese cell phone component manufacturers: 4G, Inc., and Qphone Corp. Cho indicates that his clients are most interested in the use of leverage by 4G and Qphone.

Benn states, “I will have to specifically analyze each company’s respective business risk, sales risk, operating risk, and financial risk.”

“Fine, I’ll check back with you shortly,” Cho answers.

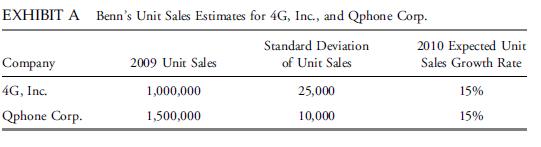

Benn begins her analysis by examining the sales prospects of the two firms. The results of her sales analysis appear in Exhibit A. She also expects very little price variability for these cell phones. She next gathers more data on these two companies to assist her analysis of their operating and financial risk.

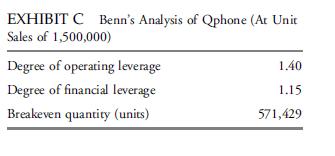

When Cho inquires as to her progress, Benn responds, “I have calculated Qphone’s degree of operating leverage (DOL) and degree of financial leverage (DFL) at Qphone’s 2009 level of unit sales. I have also calculated Qphone’s breakeven level for unit sales. I will have 4G’s leverage results shortly.”

Cho responds, “Good, I will call a meeting of some potential investors for tomorrow.

Please help me explain these concepts to them, and the differences in use of leverage by these two companies.” In preparation for the meeting, Cho says he has a number of questions:

• “You mentioned business risk; what is included in that?”

• “How would you classify the risk due to the varying mix of variable and fixed costs?”

• “Could you conduct an analysis and tell me how the two companies will fare relative to each other in terms of net income if their unit sales increased by 10 percent above their 2009 unit sales levels?”

• “Finally, what would be an accurate verbal description of the degree of total leverage?”

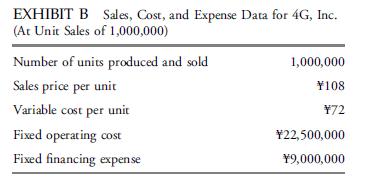

The relevant data for analysis of 4G is contained in Exhibit B, while Benn’s analysis of the Qphone data appears in Exhibit C.

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan