Which policy of the Statement of Corporate Governance is least likely to ensure effective contributions from the

Question:

Which policy of the Statement of Corporate Governance is least likely to ensure effective contributions from the board of directors?

A. Policy #1.

B. Policy #2.

C. Policy #3.

Mark Zin and Stella Lee are CEO and CFO, respectively, of Moonbase Corporation.

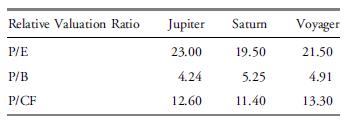

They are concerned that Moonbase is undervalued and subject to a hostile takeover bid. To assess the value of their own firm, they are reviewing current financial data for Jupiter PLC, Saturn Corporation, and Voyager Corporation, three firms they believe are comparable to Moonbase.

Zin believes Moonbase should trade at similar multiples to these firms and that each valuation ratio measure is equally valid. Moonbase has a current stock price of \($34.00\) per share, earnings of \($1.75\) per share, book value of \($8.50\) per share, and cash flow of \($3.20\) per share. Using the average of each of the three multiples for the three comparable firms, Zin finds that Moonbase is undervalued.

Lee states that the low valuation reflects current poor performance of a subsidiary of Moonbase. She recommends that the board of directors consider divesting the subsidiary in a manner that would provide cash inflow to Moonbase.

Zin proposes that some action should be taken before a hostile takeover bid is made. He asks Lee if changes can be made to the corporate governance structure in order to make it more difficult for an unwanted suitor to succeed.

In response, Lee makes two comments of actions that would make a hostile takeover more difficult. Lee’s first comment is: “Moonbase can institute a poison pill that allows our shareholders, other than the hostile bidder, to purchase shares at a substantial discount to current market value.” Lee’s second comment is: “Moonbase can instead institute a poison put. The put allows shareholders the opportunity to redeem their shares at a substantial premium to current market value.”

Zin is also concerned about the general attitude of outside investors with the governance of Moonbase. He has read brokerage reports indicating that the Moonbase governance ratings are generally low. Zin believes the following statements describe characteristics that should provide Moonbase with a strong governance rating.

Statement 1: Moonbase’s directors obtain advice from the corporate counsel to aid them in assessing the firm’s compliance with regulatory requirements.

Statement 2: Five of the ten members of the board of directors are not employed by Moonbase and are considered independent. Though not employed by the company, two of the independent directors are former executives of the company and thus can contribute useful expertise relevant for the business.

Statement 3: The audit committee of the board is organized so as to have sufficient resources to carry out its task, with an internal staff that reports routinely and directly to the audit committee.

Zin is particularly proud of the fact that Moonbase has begun drafting a “Statement of Corporate Governance” (SCG) that would be available on the company website for viewing by shareholders, investment analysts, and any interested stakeholders. In particular, the SCG pays special attention to policies that ensure effective contributions from the board of directors. These policies include:

Policy #1: Training is provided to directors prior to joining the board and periodically thereafter.

Policy #2: Statements are provided of management’s assessment of the board’s performance of its fiduciary responsibilities.

Policy #3: Statements are provided of directors’ responsibilities regarding oversight and monitoring of the firm’s risk management and compliance functions.

Zin concludes the discussion by announcing that Johann Steris, a highly regarded ex-

CFO of a major corporation, is under consideration as a member of an expanded board of directors. Zin states that Steris meets all the requirements as an independent director including the fact that he will not violate the interlocking directorship requirement. Steris also will bring experience as a member of the compensation committee of the board of another firm. He also comments that Steris desires to serve on either the audit or compensation committee of the Moonbase board and that good governance practice suggests that Steris would not be prohibited from serving on either committee.

Step by Step Answer:

Corporate Finance A Practical Approach

ISBN: 9781118217290

2nd Edition

Authors: Michelle R Clayman, Martin S Fridson, George H Troughton, Matthew Scanlan