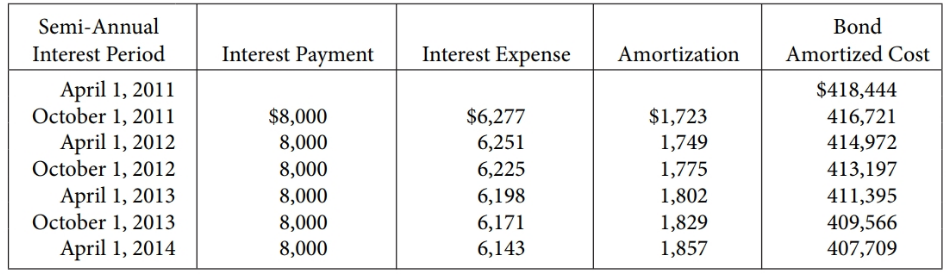

Mertsis Corporation issued $400,000 five-year bonds on April 1, 2011. Interest is paid semi- annually on April

Question:

Instructions

(a) Were the bonds issue data discount or at a premium?

(b) What is the bonds€™ face value?

(c) What will the bonds€™ amortized cost beat the maturity date?

(d) What is the bonds€™ contractual interest rate? The market interest rate?

(e) Identify what amounts, if any, would be reported as a current liability and non-current liability with respect to the bonds and bond interest accounts on March 31, 2013.

(f) What will be the total interest payment over the five-year life of the bonds? Total interest expense?

(g) Would your answers in part (f) change if the bonds had been issued at a discount instead of a premium or at a premium instead of a discount? Explain.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Principles Of Financial Accounting

ISBN: 9781118757147

1st Canadian Edition

Authors: Jerry J. Weygandt, Michael J. Atkins, Donald E. Kieso, Paul D. Kimmel, Valerie Ann Kinnear, Barbara Trenholm, Joan E. Barlow