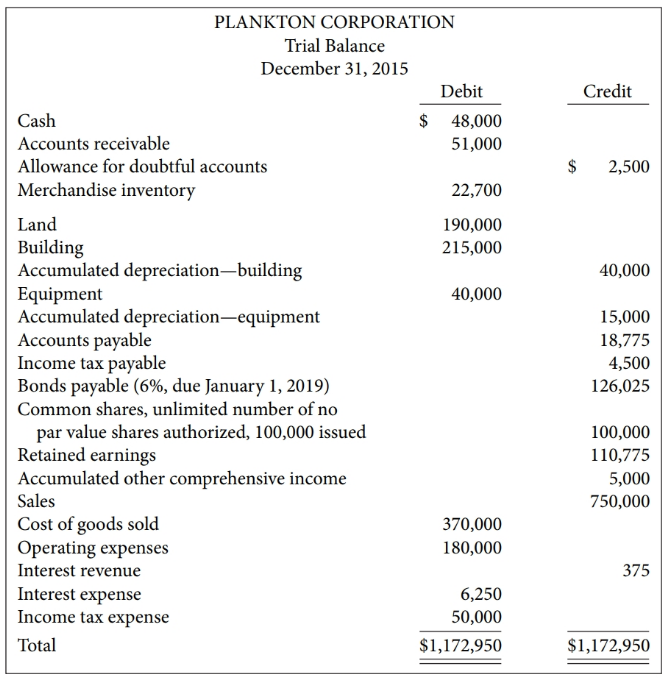

Plankton Corporations trial balance at December 31, 2015, is presented below: All transactions and adjustments for 2015

Question:

All transactions and adjustments for 2015 have been recorded and reported in the trial balance except for the items described below.

Jan. 7 Issued 1,000 preferred shares for $25,000. In total, 100,000, $2, non-cumulative, convertible, preferred shares are authorized. Each preferred share is convertible into five common shares.

Sept. 25 Five hundred of the preferred shares issued on January 7 were converted into common shares.

Nov. 30 Obtained a $50,000 bank loan by issuing a three-year, 6% note payable. Plankton is required to make equal blended payments of $1,521 at the end of each month. The first payment was made on December 31. Note that at December 31, $15,757 of the note payable is due within the next year.

Dec. 1 Declared the annual dividend on the preferred shares on December 1 to shareholders of record on December 23, payable on January 15.

31 The annual interest is due on the bonds payable on January 1, 2016. The par value of the bonds is $130,000 and the bonds were issued when the market interest rate was 7%.

Instructions

(a) Record the transactions.

(b) Prepare an updated trial balance at December 31, 2015, that includes these transactions.

(c) Using the income statement accounts in the trial balance, calculate income before income tax. Assuming Plankton has a 28% income tax rate, prepare the journal entry to adjust income taxes for the year. Note that Plankton has recorded $50,000 of income tax expense for the year to date. Update the trial balance for this additional entry.

(d) Prepare the following financial statements for Plankton:

(1) Income statement,

(2) Statement of changes in shareholders€™ equity, and

(3) Balance sheet.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Principles Of Financial Accounting

ISBN: 9781118757147

1st Canadian Edition

Authors: Jerry J. Weygandt, Michael J. Atkins, Donald E. Kieso, Paul D. Kimmel, Valerie Ann Kinnear, Barbara Trenholm, Joan E. Barlow