QP Corp. sold 4,000 units of its product at $50 per unit during the year and incurred

Question:

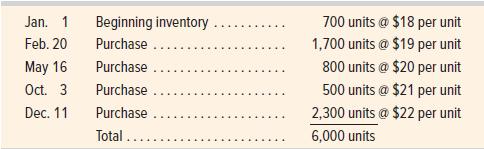

QP Corp. sold 4,000 units of its product at $50 per unit during the year and incurred operating expenses of $5 per unit in selling the units. It began the year with 700 units in inventory and made successive purchases of its product as follows.

Required

1. Prepare comparative year-end income statements for the three inventory costing methods of FIFO, LIFO, and weighted average. (Round all amounts to cents.) Include a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system.

2. How would the financial results from using the three alternative inventory costing methods change if the company had been experiencing declining costs in its purchases of inventory?

3. What advantages and disadvantages are offered by using

(a) LIFO

(b) FIFO? Assume the continuing trend of increasing costs.

Step by Step Answer:

Principles Of Financial Accounting (Chapters 1-17)

ISBN: 9781260780147

25th Edition

Authors: John Wild