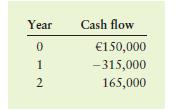

Antonio is discussing an investment opportunity with his friend, Vincenzo. It has the following projected cash flows.

Question:

Antonio is discussing an investment opportunity with his friend, Vincenzo. It has the following projected cash flows.

a. Calculate the investment’s net present value (NPV) at each of the following discount rates: 0%, 5%, 7.5%, 10%, 15%, 20%, 25%, and 30%.

b. What does the NPV profile tell you about this project’s IRR?

c. If Antonio follows the IRR decision rule and his cost of capital is 5%, should he accept or reject the investment opportunity? Why is it hard to make a decision on this investment based solely on the IRR rule?

d. If Antonio’s cost of capital is 5%, should he reject or accept the investment based on its NPV?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles Of Managerial Finance

ISBN: 9781292400648

16th Global Edition

Authors: Chad Zutter, Scott Smart

Question Posted: