Consider the following information: a. Suppose the rate of return on 3-month Treasury bills is 4%, and

Question:

Consider the following information:

a. Suppose the rate of return on 3-month Treasury bills is 4%, and the 3-month expected inflation rate is 2%. What is the real return?

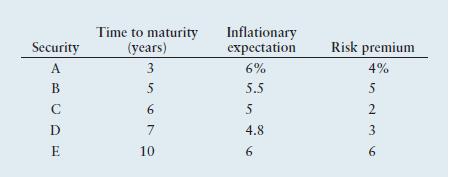

b. Based on your result in part a, what is the nominal rate of return of each security?

c. Why is the inflationary expectation for each security different?

Transcribed Image Text:

Security A B C D E Time to maturity (years) 3 5 6 7 10 Inflationary expectation 6% 5.5 5 4.8 6 Risk premium 4% 150 ~ 3 5 2 6

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

a To calculate the real return you need to subtract the expected inflation rate from the rate of return on 3month Treasury bills Real Return Rate of R...View the full answer

Answered By

User l_973071

I have a Bachelor of Science degree with a focus on biological, social, and mathematical fields. Throughout my academic journey, I have gained valuable knowledge and practical experience in these areas, enabling me to develop a well-rounded understanding of the subjects.

In the field of biology, my education has equipped me with a strong foundation in various sub-disciplines, such as molecular biology, genetics, physiology, and ecology. I have gained hands-on experience in laboratory techniques, data analysis, and scientific research methods. This has allowed me to explore the intricacies of the biological world, from the microscopic level of cells to the broader ecosystem dynamics.

Regarding social sciences, my coursework has encompassed subjects like psychology, sociology, and anthropology. I have delved into the complexities of human behavior, societal structures, and cultural influences. This multidisciplinary approach has broadened my perspective on how individuals and communities function, interact, and shape the world around them.

Mathematics has been an integral part of my academic journey as well. Through my studies, I have developed a solid understanding of various mathematical concepts, including calculus, statistics, and algebra. I have honed my problem-solving skills and analytical thinking, which are essential in tackling complex mathematical and scientific challenges.

In addition to my formal education, I have also gained tutoring experience in these fields. I have worked as a tutor, assisting students with their coursework, assignments, and exam preparation. This experience has allowed me to effectively communicate complex concepts in a clear and concise manner, adapting my teaching style to suit the needs of each student. I find great satisfaction in helping others understand and appreciate the subjects I am passionate about.

Overall, my education and tutoring experience in the biological, social, and mathematical fields have shaped me into a knowledgeable and versatile individual. I am eager to continue expanding my expertise in these areas, while also sharing my knowledge with others to foster a deeper understanding and appreciation of the sciences.

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter

Question Posted:

Students also viewed these Business questions

-

As a manager, how can you ethically engage employees with their work tasks? Describe different techniques for managing go-getters, fence-sitters, and adversarial. How would you facilitate a team...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Suppose inflation currently is about 2 percent. Last year, the Fed took action to maintain inflation at this level. Now, the economy is starting to grow too quickly, and reports indicate that...

-

Evaluate and simplify the following derivatives. d (4u + u du 8u+ 1/

-

A magnetic field is passing through a loop of wire whose area is 0.018 m2. The direction of the magnetic field is parallel to the normal to the loop, and the magnitude of the field is increasing at...

-

The file S02_35.xlsx contains (fictional) data from a survey of 500 randomly selected households. Use Excel filters to answer the following questions. a. What are the average monthly home mortgage...

-

Consider the electronic inverter data in Table B.14. Delete the second observation in the data set. Split the remaining observations into prediction and estimation data sets. a. Find the minimum...

-

1. Cash inflows from operating activities come from a. Payment for raw materials. b. Collection of sales revenues. c. Gains on the sale of operating equipment. d. Issuing capital stock. e. Issuing...

-

Is the public debt (unbalanced budget) bad? Improve, adjust, or completely change your original answer by discussing the pros and cons of debt based on what we learned. For example, - What negative...

-

The following diagram describes a service process where customers go through either of two parallel three-step processes and then merge into a single line for two final steps. Capacities of each step...

-

Your company needs to raise $50 million, and you want to issue 10-year annual coupon bonds to raise this capital. Suppose the market requires the return of your companys bonds to be 6%, and you...

-

Elliot Enterprises bonds currently sell for $1,150, have an 11% coupon interest rate and a $1,000 par value, pay interest annually, and have 18 years to maturity. a. Calculate the bonds current...

-

Find the function value using a calculator set in RADIAN mode. Round the answer to four decimal places, where appropriate. csc 4.16

-

Discuss the trade-offs of purchasing disability income insurance. Do you feel that the pros outweigh the cons?

-

DDC and Bank are finalizing the terms of a $200MM Unsecured Term Loan (UTL) with an interest rate of 5%.As part of the loan, DDC agrees it wil payoff the $50MM venture loan it previously...

-

Assume that you are the assistant manager of a hotel and are describing your hotel's meeting room to a prospective customer who is thinking of holding a seminar there. Turn the following pieces of...

-

Related to a product offering that would be considered a commodity, identify three key variables that would affect your choice of entry strategies. Using specific examples, how might these variables...

-

Compare and contrast simulating/optimizing a portfolio as a whole versus individual securities

-

Use the side-by-side boxplots shown to answer the questions that follow. (a) To the nearest integer, what is the median of variable x? (b) To the nearest integer, what is the ï¬rst quartile...

-

The rate at which the temperature of an object changes is proportional to the difference between its own temperature and the temperature of the surrounding medium. Express this rate as a function of...

-

For each of the cases in the following table: a. Calculate the future value at the end of the specified deposit period. b. Determine the effective annual rate, EAR. c. Compare the nominal annual...

-

For each of the cases in the following table, find the future value at the end of the deposit period, assuming that interest is compounded continuously at the given nominal annualrate. Amount of...

-

You plan to invest $2,000 in an individual retirement arrangement (IRA) today at a nominal annual rate of 8%, which is expected to apply to all future years. a. How much will you have in the account...

-

A salad is any combination of the following ingredients: (1) tomato, (2) lettuce, (3) spinach, (4) carrot, and (5) oil. Each salad must contain: (A) at least 15 grams of protein, (B) at least 2 and...

-

Write functions that will compute the state and county sales tax. Assume the state sales tax is 5 percent and the county sales tax is 2.5 percent. Each function should return the amount of sales tax,...

-

Think critically about the sociological theories of deviance, the various forms of social control, and the U.S. Criminal Justice System among other themes presented: Discuss how sociologists view,...

Basic Biostatistics Statistics For Public Health Practice 2nd Edition - ISBN: 1284036014 - Free Book

Study smarter with the SolutionInn App