Eddie Greer recently inherited a large amount of money from his grandfather. His financial advisor has suggested

Question:

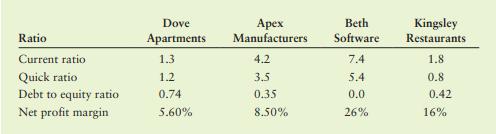

Eddie Greer recently inherited a large amount of money from his grandfather. His financial advisor has suggested to invest equally in four companies to create a stock portfolio. Wishing to learn more about the companies in which he will invest, Eddie performs a ratio analysis on each company and decides to compare them. Some of his ratios are listed below.

Dove Apartments owns a residential complex in the city center and rents the apartments to students and professionals; Apex Manufacturers produce PVC frames for windows and doors for the construction industry; Beth software provides online security services; and Kingsley Restaurants is a chain of pubs and restaurants.

Assuming that Eddie’s financial advisor has selected the portfolio with care, Eddie finds the differences in the ratios of the four companies confusing. Help him out.

a. What fundamental problem might Eddie encounter in comparing these companies on the basis of their ratios?

b. Why might the current and quick ratios for Dove Apartments be much lower than the same ratios for Apex Manufacturers?

c. Why is it acceptable for the Dove Apartments to carry a large debt, but not Beth Software?

d. Why should Eddie invest in Dove Apartments and Apex Manufacturers, which are earning a lower net margin than the other two companies? Will he be better off investing all his money in Beth Software instead of in less profitable companies?

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart