Harte Textiles Inc., a maker of custom upholstery fabrics, is concerned about preserving the wealth of its

Question:

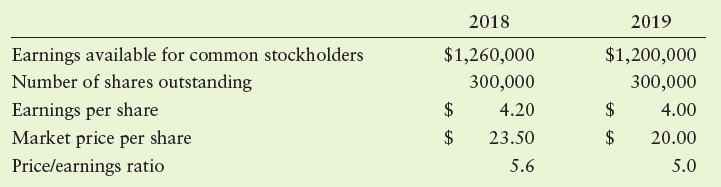

Harte Textiles Inc., a maker of custom upholstery fabrics, is concerned about preserving the wealth of its stockholders during a cyclical downturn in the home furnishings business. The company has maintained a constant dividend payout of $2.00 tied to a target payout ratio of 40%. Management is preparing a share repurchase recommendation to present to the firm’s board of directors. The following data have been gathered from the past 2 years.

a. How many shares should the company have outstanding in 2019 if its earnings available for common stockholders in that year are $1,200,000 and it pays a dividend of $2.00, given that its desired payout ratio is 40%?

b. How many shares would Harte have to repurchase to have the level of shares outstanding calculated in part a?

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Principles of Managerial Finance

ISBN: 978-0134476315

15th edition

Authors: Chad J. Zutter, Scott B. Smart