Irvin Enterprises is considering the purchase of a new piece of equipment to replace the current equipment.

Question:

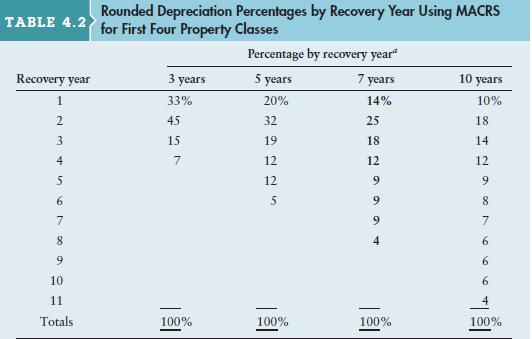

Irvin Enterprises is considering the purchase of a new piece of equipment to replace the current equipment. The new equipment costs $75,000 and requires $5,000 in installation costs. It will be depreciated under MACRS using a 5-year recovery period. The old piece of equipment was purchased 4 years ago for an installed cost of $50,000; it was being depreciated under MACRS using a 5-year recovery period. The old equipment can be sold today for $55,000 net of any removal or cleanup costs. As a result of the proposed replacement, the firm’s investment in net working capital is expected to increase by $15,000. The firm pays taxes at a rate of 40%. (Table 4.2 on page 166 contains the applicable MACRS depreciation percentages.)

Table 4.2:

a. Calculate the book value of the old piece of equipment.

b. Determine the taxes, if any, attributable to the sale of the old equipment.

c. Find the initial investment associated with the proposed equipment replacement.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter