Lifestyle International, a wholesales company in India, is looking to get a loan using its accounts receivable

Question:

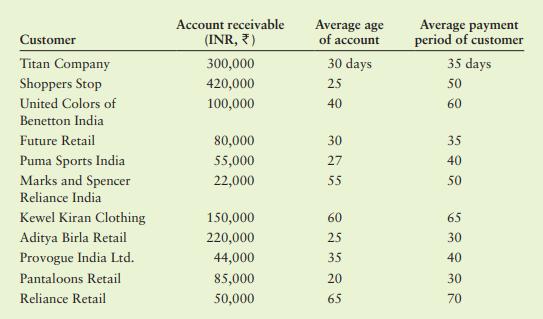

Lifestyle International, a wholesales company in India, is looking to get a loan using its accounts receivable as collateral. The firm’s credit extension is net-30-day credit. The amounts that are owed Lifestyle by its main clients, the average for each account, and the average payment period from each client are shown in the following table.

a. If the bank accepts all accounts that can be collected in 40 days or less as long as the customer has a history of paying within 40 days, which accounts will be acceptable? What is the total amount of accounts receivable collateral? Accounts receivable that have an average age greater than the customer’s average payments period are also excluded.

b. In addition to the conditions in part a, the bank recognizes that 8% of credit sales will be lost to returns and allowances. Also the bank will lend only 85% of the acceptable collateral (after adjusting for returns and allowances). What level of funds would be made available through this lending source?

Step by Step Answer:

Principles Of Managerial Finance Brief

ISBN: 9781292267142

8th Global Edition

Authors: Chad J. Zutter, Scott B. Smart